Subscribe

"Unlock exclusive insights and elevate your financial wisdom with NetWorth.com — subscribe now to stay ahead in the wealth game!"

Small business owners deserve a checking account that enhances, rather than restricts, their daily operations. Bluevine Business Checking might be the ideal solution.

Founded in 2013, Bluevine’s online banking platform offers a business checking account with unlimited transactions, minimal fees, and many other useful features.

In this review, we explore everything Bluevine Business Checking offers and compare it to the competition, helping you determine if it’s the right fit for your business.

>> Join Bluevine Business Checking Account! >>

Bluevine Business Checking offers many features with minimal fees. Many business checking accounts either don’t pay interest or offer very low rates, so Bluevine’s competitive rate means more money for small businesses, especially if you maintain larger balances.

While Bluevine has no physical branches, it provides ample ways to manage your money through ATMs, cash deposits, and mobile access, reducing the need for in-person banking. However, if your business frequently makes cash deposits, the Green Dot cash deposit fee might be a drawback.

Since Bluevine offers only a single business checking account, you might need accounts at multiple banks to meet all your business needs. Having all your accounts under one roof is more convenient and can come with relationship benefits for opening multiple accounts.

Despite this, Bluevine Business Checking might still be worth considering with its many perks and lack of fees.

Pros

Cons

Features | |

| Monthly Fee | $0 |

| Minimum Deposit | $0 |

| Overdraft Fees | $0 |

| APY | 1.50% on balances up to $100,000 |

| Transactions | Unlimited |

| Account Types | Business checking and business loans |

| Cash Deposits | $4.95 |

| ATM Fees | $0 in-network,$2.50 out of network |

| Outgoing Wires | $15 |

No fees and unlimited transactions are standard for online business checking accounts, but Bluevine goes further with its free, high-yield business account.

Bluevine’s business account earns 2.00% interest on balances up to $100,000—one of the best rates available from a business checking account. Bluevine also allows cash deposits, unlike most online-only accounts, though for a fee.

Bluevine, a financial technology company, was launched in 2013 and started offering business checking in 2019. Its banking services are provided by Coastal Community Bank, with all accounts insured by the Federal Deposit Insurance Corp. (FDIC) up to $250,000.

Bluevine Business Checking can be an excellent choice for businesses that want to keep costs low, make unlimited transactions without worrying about fees, and earn interest on unused capital.

As long as your business doesn’t need to deposit cash frequently and you don’t require in-person banking services, Bluevine Business Checking is worthy of a spot on your shortlist.

Bluevine Business Checking is best for small business owners who:

>> Apply for a Bluevine Business Checking Account! >>

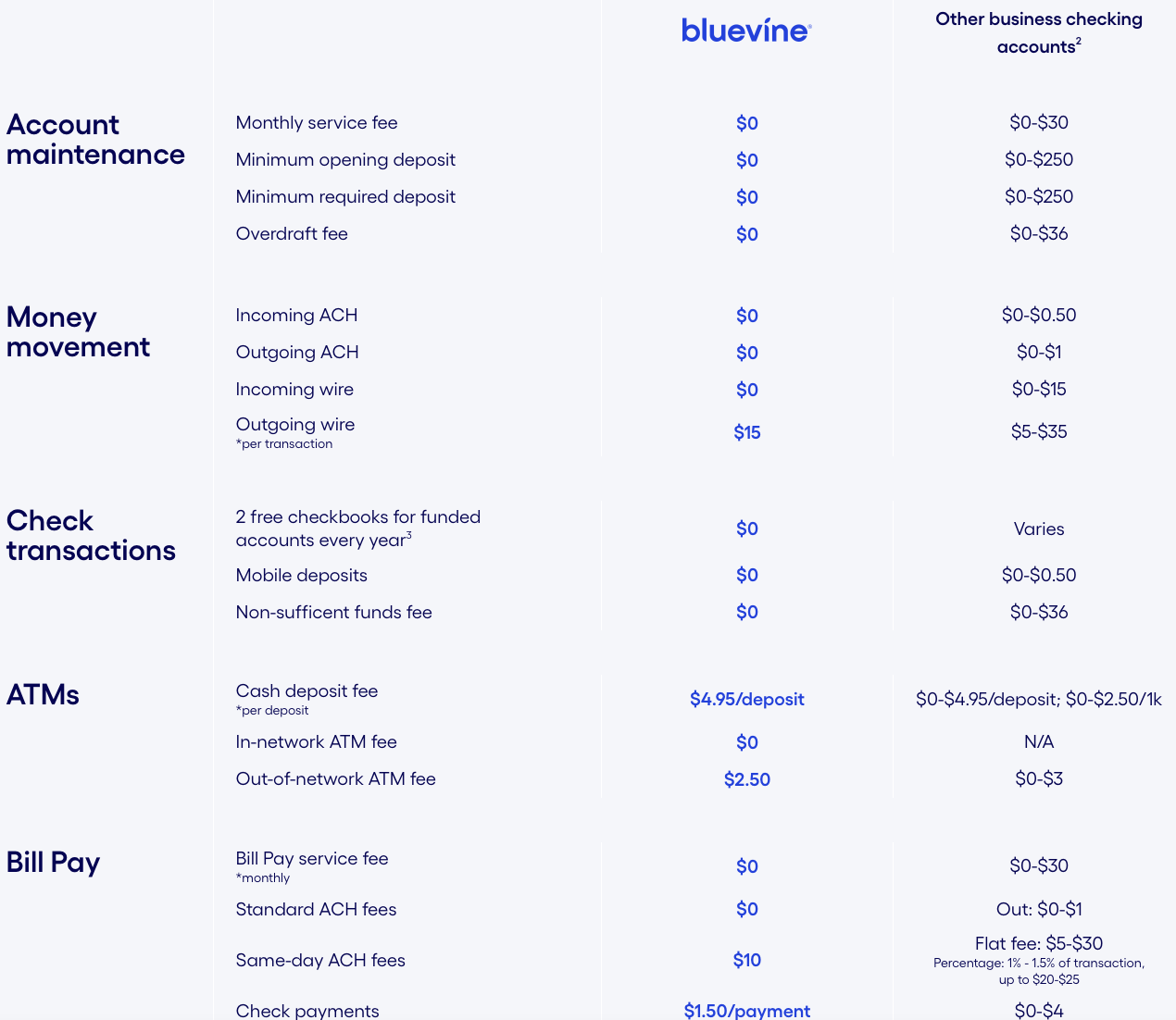

Bank fees can be problematic, especially when running a profitable business. Bluevine Business Checking helps by eliminating many common fees and minimums, offering:

The checking account also allows unlimited transactions each month with no fees. While Bluevine offers no other accounts, you can easily transfer funds in and out of your checking account from accounts at other financial institutions.

Bluevine charges a $2.50 fee for ATM transactions outside the MoneyPass network. Bluevine has introduced a new Premier tier, which helps small business owners earn even higher interest, access priority support, and reduce most payment fees by half.

With the Premier tier, Bluevine Business Checking can now offer up to 4.25% APY. For businesses with higher cash balances and many payments to make, Bluevine Premier provides unparalleled value.

>> Join Bluevine for Innovative Business Banking Solutions! >>

Bluevine offers only one account, but its features are impressive. Bluevine Business Checking is an interest-bearing online business bank account that currently earns a competitive 2.00% APY on balances up to $100,000. (Balances over $100,000 do not earn interest.)

To qualify for the 2.00% APY, you must either spend $500 per month with your Bluevine Business Debit Mastercard or receive $2,500 per month in customer payments into your Bluevine Business Checking account via ACH, wire transfer, mobile check deposit, or directly from your merchant payment processing provider. Bluevine Business Checking also offers up to 4.25% APY for premier customers.

Paying vendors with Bluevine Business Checking is straightforward. As a small business owner, you have access to various payment methods, including ACH, wire transfer, and checks.

You can make one-time bill payments or set up recurring automatic payments for added convenience. With recurring payments, you can see the exact day the payment will arrive at the payee, helping you avoid late payments.

Bluevine also provides an online directory of 40,000 registered vendors, and you can easily add your own as needed. You can make payments by credit card through Bluevine’s online payment system.

As an online banking platform, Bluevine has no physical branches for in-person services. However, customers still have access to several transaction options through partnerships with other financial networks.

Bluevine Business Checking includes a free Bluevine Business Debit Mastercard and two free checkbooks. Customers can use over 38,000 fee-free ATMs across the U.S. by partnering with the MoneyPass ATM network.

Despite lacking branches, small business owners can make cash deposits with Bluevine by partnering with Green Dot. You can deposit cash at the register at over 90,000 taking part U.S. retail locations. Note that Green Dot charges a fee of up to $4.95 per cash deposit, and deposits may be subject to Green Dot daily limits.

Bluevine is a financial technology company, not a bank. Its banking services are provided through a partnership with Coastal Community Bank, Member FDIC. Coastal Community Bank offers FDIC insurance for all Bluevine Business Checking accounts up to the legal limits.

Customers have access to Bluevine’s mobile app, enabling them to make mobile check deposits and perform other daily transactions as needed. The app allows Small business owners to manage their finances and cash flow from anywhere.

Besides checking, Bluevine offers a business line of credit up to $250,000 for significant purchases. Interest rates start at 4.8%, and you may get approved within minutes.

To qualify, you’ll need a FICO score of at least 600, a minimum monthly income of $10,000, and at least six months in business incorporated or operating in a U.S. state.

After answering a few additional questions and providing access to current bank statements, Bluevine will decide on your loan. Explore the best options if you’re considering a business loan despite bad credit.

>> Check Out the Best Features of the Bluevine >>

You can open a Bluevine business account online or via the Bluevine app. Bluevine Business Checking is available to business owners in all 50 states and the District of Columbia. You must be at least 18 years old and a U.S. citizen or resident with a valid U.S. address (not a P.O. Box) to be eligible. Certain types of businesses are restricted.

To open a Bluevine business account, you need to provide basic details about yourself and your business. Applicants must also provide certain documentation, depending on their business entity type.

Bluevine business checking applications are usually reviewed within three business days. Once approved, you can activate your account, order your Bluevine debit card, and fund your account.

Bluevine business checking accounts earn 2.00% APY on balances up to and including $100,000, provided you meet either of the two monthly requirements:

>> Apply for a Bluevine Business Card >>

For deposits and withdrawals, Bluevine Business Checking Account users have several options.

There are four main ways customers can deposit money into their Bluevine Business Checking Account:

Aside from the standard methods like writing checks and wire transfers, Bluevine Business Checking Account owners receive a business debit card.

This card allows fee-free cash withdrawals at over 38,000 MoneyPass ATMs nationwide. For out-of-network ATM withdrawals, customers will incur a surcharge. Bluevine Payments lets you send money directly to third parties.

Bluevine has no public controversies and holds an A+ rating from the Better Business Bureau (BBB). This strong BBB grade shows that the company advertises honestly, responds effectively to customer complaints, and is transparent about its business practices.

However, a great BBB grade doesn’t guarantee a smooth relationship with the company. It’s still a good idea to read online customer reviews or ask friends and family about their experiences with Bluevine.

>> Open Your Bluevine Business Account Today! >>

The short answer is yes. Bluevine is a financial technology company. Celtic Bank, a Utah-chartered bank and member of the FDIC, issues the Bluevine line of credit.

Bluevine also offers a small-business checking account through Coastal Community Bank. According to Crunchbase, which tracks startups, the private company has raised $769.2 million in funding.

The aggregated limit for all ATM cash withdrawals, cash back at POS, and OTC cash withdrawals is $2,000.00 per calendar day. ATM owners, merchants, and participating banks may impose their own fees and lower limits on cash withdrawals. Cash withdrawals at MoneyPass ATMs are surcharge-free.

Bluevine is FDIC-insured through Coastal Community Bank (FDIC Certificate No. 34444). When you deposit money into an FDIC-insured account at Bluevine, your funds are protected up to $250,000 per depositor, per account ownership category, in case of a bank failure.

Bluevine Business Checking is a great option for small businesses due to its limited fees and the ability to accrue interest on balances up to $100,000. It stands out on Select’s list of best business checking accounts as the only one that yields interest on your balance.

>> Sign Up for Bluevine & Simplify Your Finances! >>