Subscribe

"Unlock exclusive insights and elevate your financial wisdom with NetWorth.com — subscribe now to stay ahead in the wealth game!"

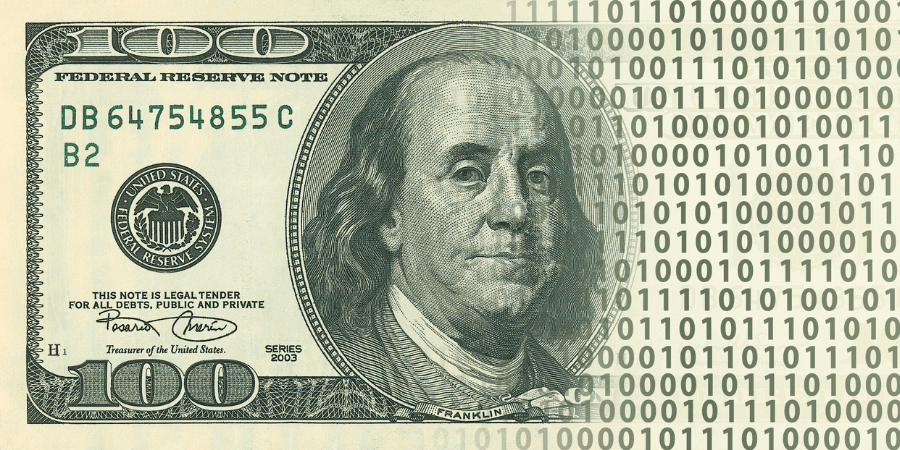

In this article, we will discuss what a digital dollar or CBDC is, its benefits and risks, and the current status of its potential launch in the United States.

Key Takeaways:

If Congress approves, the U.S. Treasury may soon create a digital currency. The potential launch of a digital dollar or central bank digital currency (CBDC) has recently come into the spotlight, especially after China began publicly testing a digital currency in 2020.

A digital dollar or CBDC is a type of digital currency that is supported by the government and is as easy to use as cash for the public.

Unlike the digital money that’s currently available to the public, a CBDC would be issued by the Federal Reserve and not by a commercial bank. It’s possible for a CBDC to be used in conjunction with cash.

Experts have put forth arguments in favor of a US digital dollar, including its potential to provide financial services to people who don’t have access to banks.

Some experts have suggested that the Federal Reserve should also have the ability to offer bank accounts alongside the digital currency.

However, there are also risks associated with retail CBDCs. In particular, there is a possibility that during times of economic stress, individuals may rush to withdraw their funds from a retail CBDC, which could lead to instability in the private lending sector.

During an event hosted by the Atlantic Council’s GeoEconomics Center, Nellie Liang, the undersecretary for domestic finance at the Treasury, stated that the Treasury is working on the technology needed for a CBDC.

This is to ensure that they can act quickly if it’s in the best interest of the country. The Federal Reserve and other groups are working with the Treasury to determine what a CBDC might look like.

The Treasury Department is examining critical aspects such as privacy, national security, and the dollar’s part in the global financial system. However, Congress must support any action that may occur.

The Treasury Department is leading a senior-level working group to discuss the possible launch of a digital dollar. The group includes leaders from the Treasury, Federal Reserve, National Security Council, and other agencies.

However, it’s important to note that the Treasury and the Federal Reserve are not yet convinced that a CBDC is needed.

The Fed is conducting research and experimentation to inform design choices so that it is prepared to issue a CBDC if it is deemed to be in the national interest.