Subscribe

"Unlock exclusive insights and elevate your financial wisdom with NetWorth.com — subscribe now to stay ahead in the wealth game!"

Cryptocurrencies have revolutionized the financial world, offering decentralized and borderless transactions. However, the tax implications of cryptocurrency transactions can be complex and confusing.

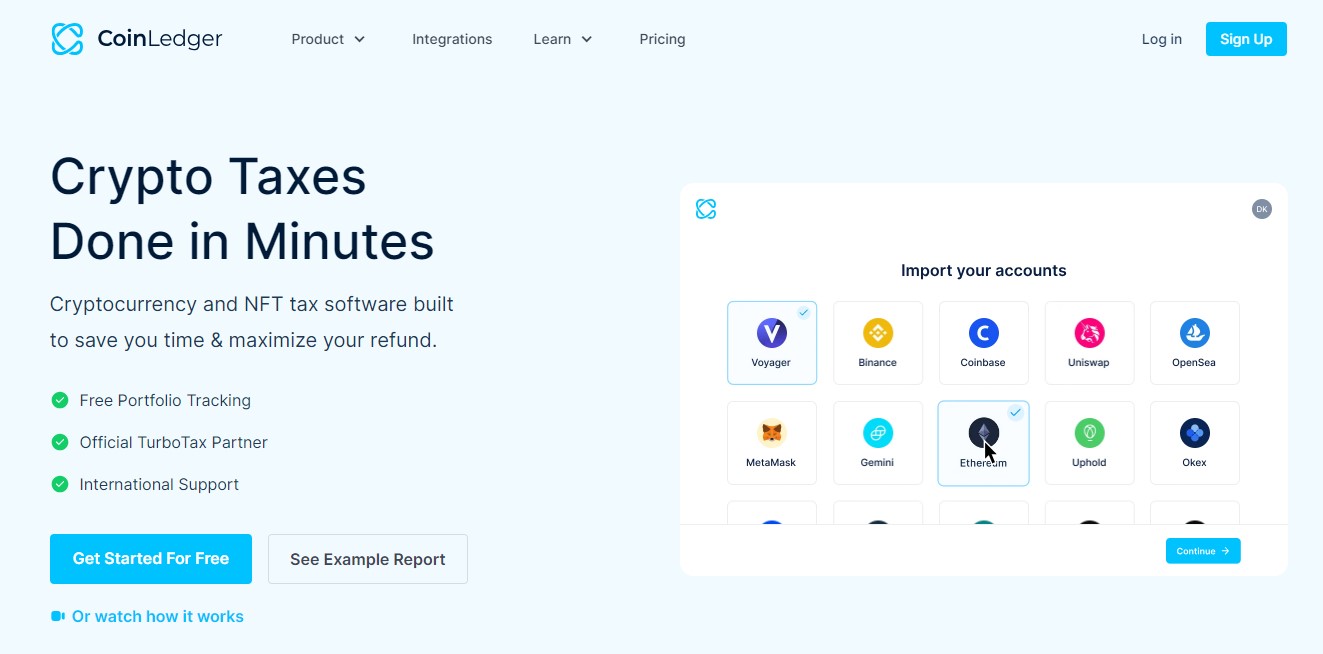

To simplify the process, numerous software platforms have emerged, one of which is CoinLedger. In this comprehensive guide, we will explore the features, benefits, pricing, and integrations of CoinLedger, making it easier for you to streamline your crypto tax reporting.

CoinLedger offers a free portfolio tracking tool, ensuring you’re in control of your assets without spending a dime.

Seamlessly integrate CoinLedger with traditional tax software, simplifying the tax season process and eliminating complexities.

From trading profits to staking rewards and the intriguing realm of NFTs, CoinLedger covers all angles of income tracking.

Access in-depth details effortlessly, empowering you with a comprehensive understanding of your crypto landscape.

CoinLedger is a leading crypto tax software that provides individuals and businesses with a seamless solution for calculating and reporting their crypto taxes.

CoinLedger was founded in 2018 as CryptoTrader.Tax. David Kemmerer, Lucas Wyland, and Mitchell Cookson developed the crypto tax platform. The team’s experience in automated trading systems led them to recognize the need for a tool to track and report cryptocurrency transactions accurately.

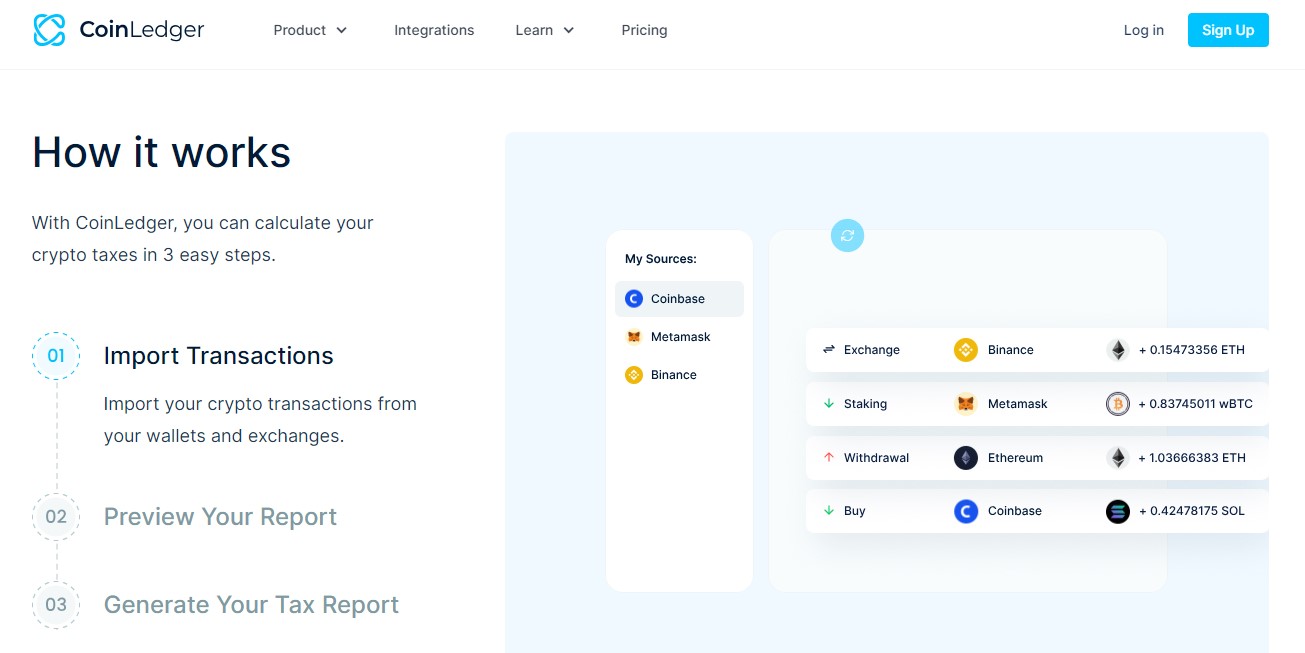

With CoinLedger, users can import their transaction data from popular cryptocurrency exchanges such as Coinbase, Binance, Gemini, and more. The platform automatically classifies transactions based on their tax treatment, generating detailed tax reports that can be easily exported to tax filing software like TurboTax, TaxACT, TaxSlayer, and H&R Block.

CoinLedger simplifies the process of generating accurate tax reports. The platform offers a wide range of tax reports, including:

CoinLedger offers a robust portfolio tracking tool that allows you to consolidate all your cryptocurrency holdings in one place. By syncing your wallets and exchanges, you can easily monitor the value of your portfolio, track trading data, and analyze your income from activities like staking, lending, and liquidity mining. The portfolio tracker provides valuable insights into your crypto investments, helping you make informed decisions.

With the rise of non-fungible tokens (NFTs), CoinLedger recognizes the need to track and report NFT transactions accurately. The platform allows users to consolidate NFTs across multiple chains, providing a comprehensive view of their NFT holdings. By syncing their wallets and NFT exchanges, investors can track their gains and losses from trading NFTs, a feature that is often unavailable in other tax software.

Understanding the tax implications of cryptocurrency transactions is crucial for investors. CoinLedger provides country-specific tax guides, offering high-level tax information and detailed breakdowns of more complex activities such as margin trading and donations. Whether you are a beginner or an experienced investor, Crypto Taxes 101 provides valuable insights to help you navigate the ever-changing landscape of crypto taxation.

CoinLedger understands that many individuals and businesses rely on tax professionals to handle their crypto taxes. To facilitate collaboration between taxpayers and tax professionals, the platform offers a customizable suite for tax professionals. With the same features available on the platform, tax professionals can invite their clients to CoinLedger, guiding them step-by-step in importing their transactions and generating accurate tax reports.

CoinLedger offers flexible pricing options to cater to users with different transaction volumes.

The pricing plans are as follows:

It’s important to note that all pricing tiers provide access to the same features, such as tax reports, portfolio tracking, NFT tax software, and tax loss harvesting. The primary difference lies in the number of transactions supported by each plan. CoinLedger also offers a free version that allows users to import and track their transaction data but does not include automated tax report generation.

CoinLedger integrates with various cryptocurrency exchanges, wallets, and tax filing software. Some of the notable integrations include:

CoinLedger’s API integration allows users to directly import their transaction data from these exchanges, simplifying the process of tracking and reporting their crypto taxes.

CoinLedger supports integration with popular crypto wallets. This enables users to seamlessly import their transaction history and generate accurate tax reports.

CoinLedger’s integration with these tax filing software platforms allows users to directly export their tax reports and seamlessly file their crypto taxes.

When it comes to handling sensitive financial data, security is of utmost importance. CoinLedger takes comprehensive measures to ensure the safety and security of user information. Although CoinLedger does not hold user assets, it hosts and analyzes imported transaction data.

CoinLedger implements industry-standard security features, including complex encryption standards for passwords and credentials. User data is protected using 256-bit encryption, and all servers are hosted on CoinLedger’s virtual private cloud (VPC), restricting unauthorized access.

To date, CoinLedger has not experienced any major security breaches, providing users with peace of mind when entrusting their financial data to the platform.

CoinLedger offers extensive customer support options to assist users with any questions or issues they may encounter. The platform provides a comprehensive help center, which includes detailed guides and frequently asked questions.

Users can also contact CoinLedger’s support team via email at [email protected]. An AI chat option is available on the platform, providing quick assistance for minor issues or general inquiries.

CoinLedger is an ideal solution for individuals and businesses involved in cryptocurrency transactions. Whether you are a casual investor, a day trader, or a tax professional, CoinLedger offers the tools and features necessary to streamline your crypto tax reporting.

The platform’s diverse pricing options cater to users with different transaction volumes, making it accessible to both occasional and high-frequency traders. Additionally, CoinLedger’s integration with popular exchanges, wallets, and tax filing software ensures a seamless and efficient experience for users.

Delve into the heart of CoinLedger’s offerings with these essential FAQs:

Certainly! CoinLedger streamlines crypto tax preparations for traders, simplifying the process. However, note that it doesn’t file taxes like TurboTax or H&R Block; that task remains with you.

Rest assured, your crypto assets are safe. CoinLedger employs a read-only API to access exchange data without touching your private keys. For extra security, consider transferring your keys to a hardware wallet before dealing with taxes.

Transferring cryptocurrencies between wallets doesn’t trigger tax obligations. However, reporting is necessary if your wallet activities involve trades, interest, rewards, or other taxable events.

CoinLedger welcomes traders worldwide. It can generate comprehensive crypto reports, including gains, losses, and income in any currency, transcending geographical boundaries.

Navigating the complexities of crypto tax reporting can be daunting. CoinLedger simplifies the process with its intuitive platform. By providing automated transaction tracking, accurate tax reports, and extensive integrations, CoinLedger empowers individuals and businesses to stay compliant with their crypto taxes.

Whether you are an investor, a day trader, or a tax professional, CoinLedger’s comprehensive features and competitive pricing make it a valuable tool for streamlining your crypto tax reporting. Take control of your crypto taxes today and experience the convenience and accuracy of CoinLedger.