Subscribe

"Unlock exclusive insights and elevate your financial wisdom with NetWorth.com — subscribe now to stay ahead in the wealth game!"

Relay is a financial technology company that provides business checking and savings accounts with minimal fees. It’s perfect for business owners looking to simplify their finances and implement a “Profit First” cash flow strategy. It’s also useful for managing multiple employees or freelancers with various bank accounts and debit cards.

However, Relay may not be the best choice if you need credit cards, loans, or an interest-bearing checking account. This review will cover the features and drawbacks of Relay business checking accounts and services. Read on to learn more.

>> Explore Relay Bank’s Features Now! >>

Relay Bank Review

Relay is a financial technology company offering FDIC-insured business banking accounts through Thread Bank. Previously partnered with Evolve Bank and Trust, Relay’s newer features, including cash deposits and savings accounts, are part of “Relay 2.0.” This applies to accounts opened in 2023 or those migrated to Thread-supported services.

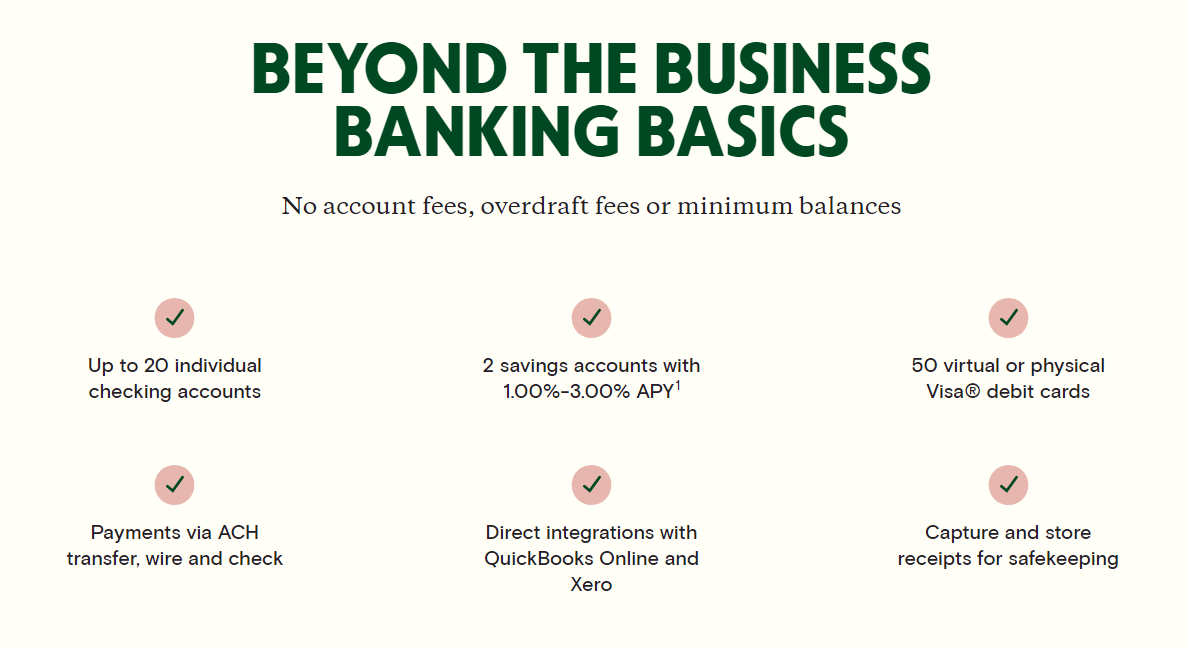

Relay offers no minimum balance requirements, transaction limits, or overdraft fees, plus free incoming wire transfers and the ability to deposit cash at AllPoint ATMs.

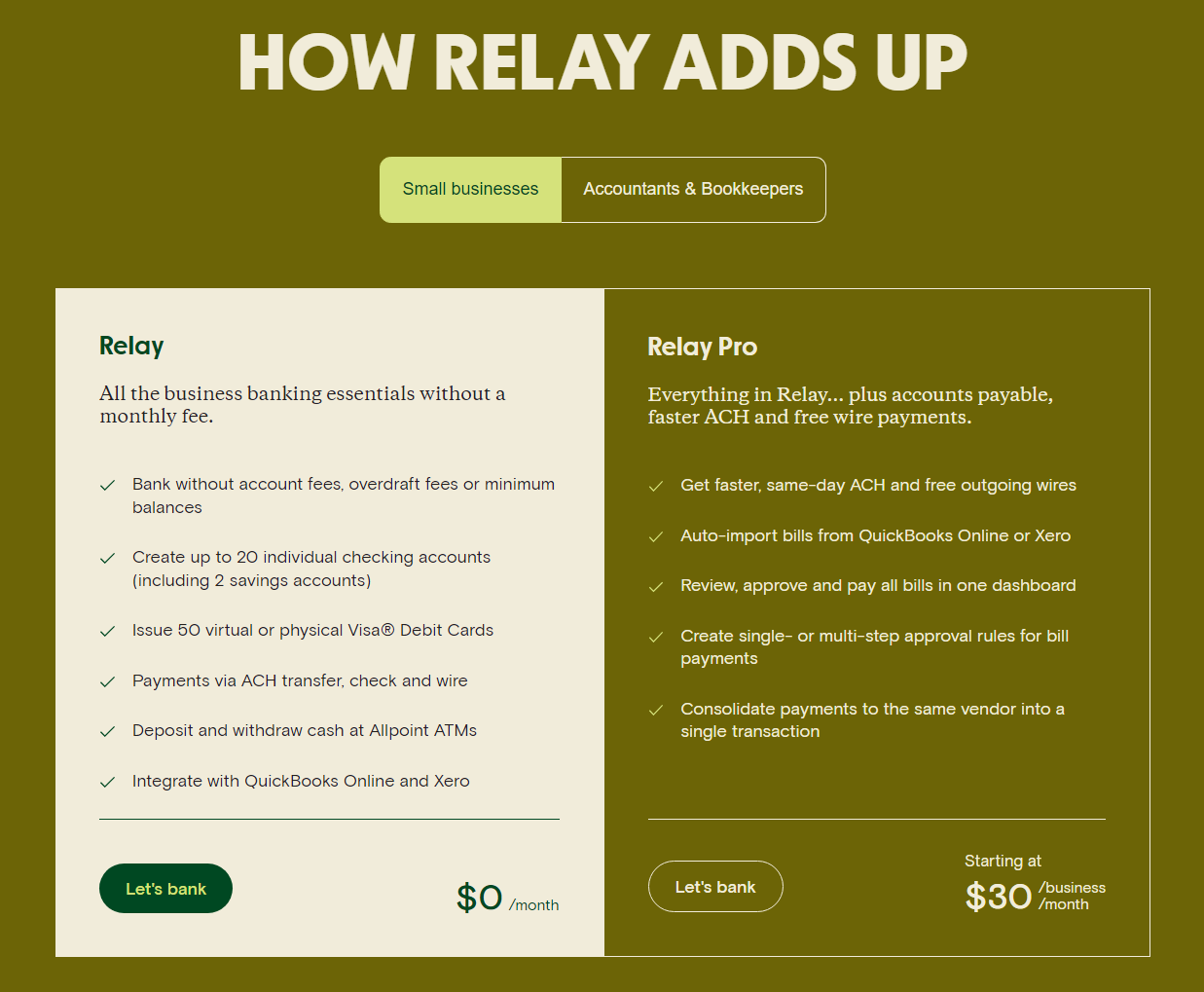

Relay’s premium account, Relay Pro, costs $30 per month and includes:

Relay offers a high-yield business savings account with FDIC insurance of up to $2.5 million through the Insured Cash Sweep program. It features no monthly fee or minimum balance requirement but has a tiered interest structure:

This account does not include checks, a debit card, or ATM access; money can only be transferred internally between Relay Checking accounts.

>> Discover the Benefits of Relay Bank Today! >>

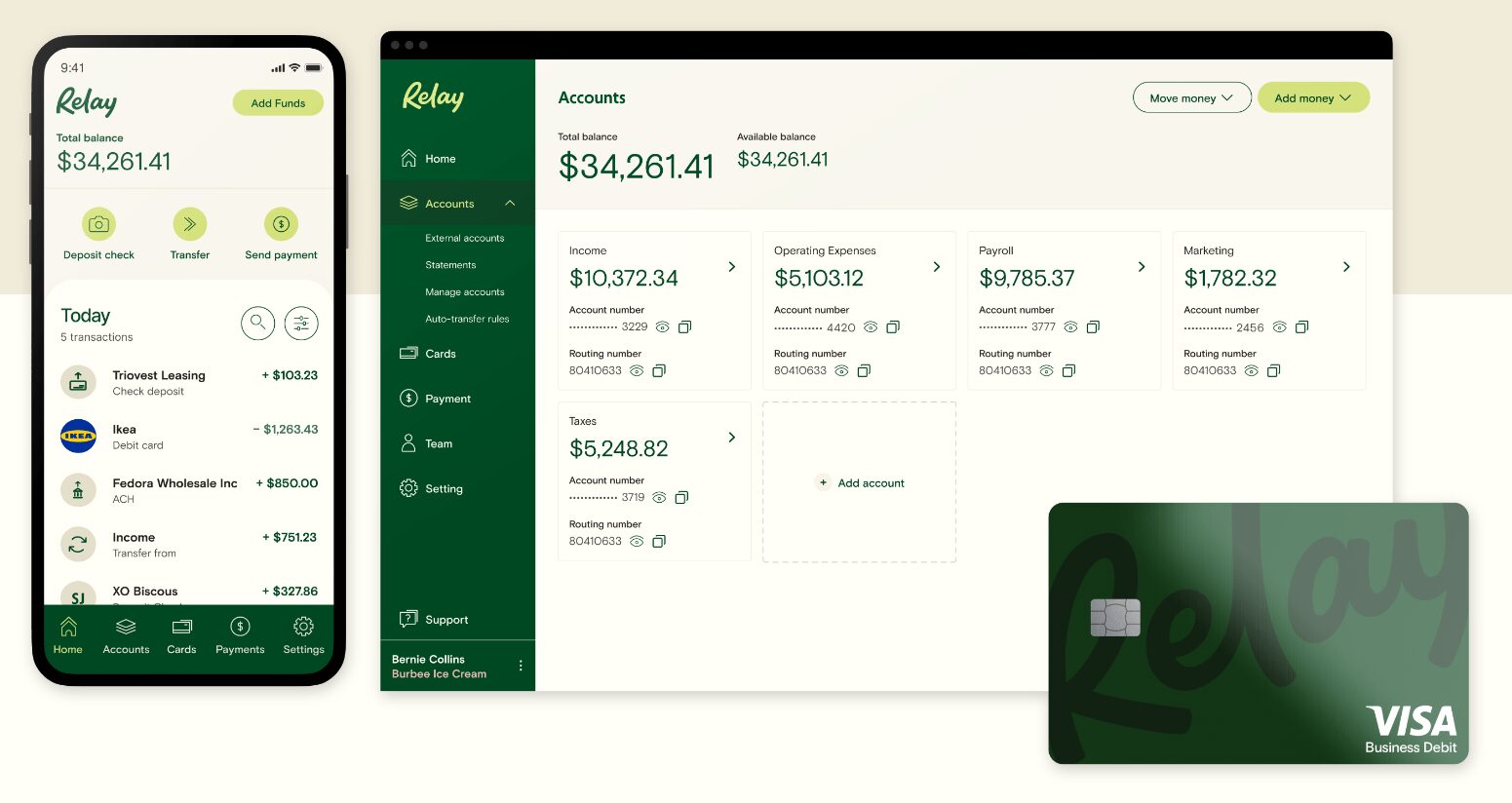

Relay allows you to create up to 20 individual subaccounts under a single account name for LLCs and corporations and 10 for sole proprietorships. Each account is FDIC-insured and comes with its own account number. You can instantly transfer money between accounts to manage expenses like taxes, payroll, and operating costs.

Upon opening an account, Relay sends a physical debit card to your business address. You can issue up to 50 virtual or physical Visa debit cards, each tied to specific checking accounts. The cards can be used anywhere that accepts credit cards and are compatible with Apple, Google, and Samsung Pay for in-person transactions. Withdrawals and deposits at Allpoint ATMs are fee-free.

You can grant team members access to specific subaccounts and debit cards, set spending and ATM withdrawal limits, and monitor card activity. This allows employees to handle financial tasks without having too much control over their funds.

>> Start Banking Smarter With Relay Bank! >>

Relay integrates seamlessly with QuickBooks Online and Xero, allowing you to import transaction data directly into your accounting software, simplifying the process of updating bank feeds and tracking cash flow.

Each transaction entry includes comprehensive details, such as the amount paid, recipient, debit card used, and checking account involved. You can search transactions by payment type, merchant, card name, or initiator to reconcile accounts efficiently.

Relay’s mobile app, rated 4.7 on the App Store and 4.4 on Google Play, allows you to:

Relay offers up to $2.5 million in FDIC insurance protection through a sweep program with Thread Bank.

Relay Pro, at $30 per month, includes:

Relay allows up to two savings accounts per business. The APY rates vary based on balance:

Relay enables you to pay bills using free same-day ACH transfers, checks, or domestic and international wires. The platform includes a currency conversion option and allows you to handle payees and upload vendor details like W-9 forms.

Relay’s integrated tools and services aim to streamline financial management for small businesses, offering a range of features to support various financial needs.

As a small business owner, managing finances can be challenging, so it’s essential to understand Relay’s pricing structure thoroughly.

One of Relay’s advantages is the absence of minimum balance requirements. Whether you use Relay’s free account or upgrade to Relay Pro, you won’t need to maintain a specific balance in your account.

Relay’s basic plan is entirely free, which makes it an excellent choice if affordability is a priority. For businesses that need additional features like same-day ACH and advanced billing capabilities, the Relay Pro plan costs $30 per month. Both plans allow you to have up to 20 individual checking accounts without any monthly fees.

Relay allows free, unlimited withdrawals at AllPoint ATMs and fee-free withdrawals at any ATM worldwide, though ATM owners may charge a fee. For Relay’s physical cards, there’s a maximum daily card transaction limit of $7,000 and an ATM withdrawal limit of $1,000 per card.

Relay generally offers a fee-free structure for most services. However, it’s crucial to identify any specific fees that might apply to your business, such as wire transfer fees.

Relay’s international transfer system is easy to use. Pricing is straightforward but not particularly cheap at $10 per outgoing transaction. However, this fee is waived for Relay Pro plan users.

Relay bases their exchange rate on the foreign exchange market, updating every 60 seconds. They apply a rate that is 1% or above the market rate, depending on the currency and the time of the conversion. You’ll see exactly what you’ll be charged and what the recipient will receive before you complete the conversion.

By understanding these costs and features, you can better assess how Relay fits into your business’s financial management strategy.

Relay is a business checking account designed for small business owners and entrepreneurs. It features checking accounts with no minimum balance requirements, fees, or transaction limits. Additionally, business owners can add employees to their accounts and assign permissions based on their roles.

Relay can also be an excellent banking solution for e-commerce or online businesses. It seamlessly pulls deposits from payment processors like Stripe and Square and integrates with QuickBooks and Xero to streamline cash management.

However, established business owners looking to scale their company may find Relay less suitable, as it does not offer lines of credit or business loans, which are crucial for business growth.

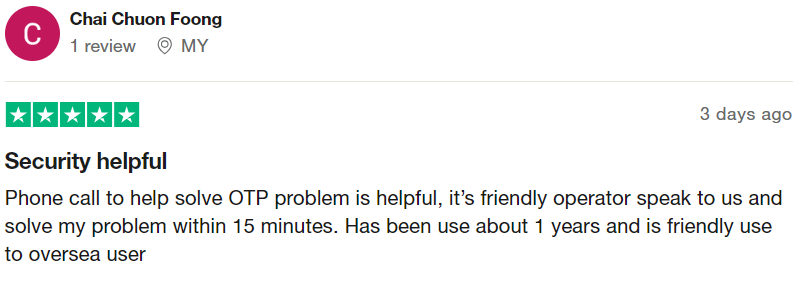

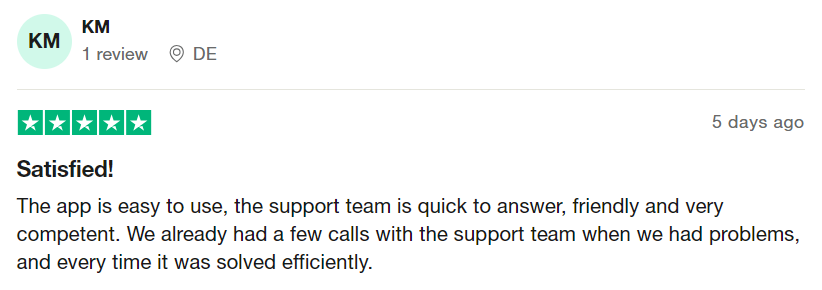

Reviews for Relay business checking are largely positive. The platform boasts a 4.6 rating from over 1,300 reviews on Trustpilot. Users have praised Relay’s responsive customer support team and clear communication. They also value the ability to open multiple accounts for free and the ease of setting up an account. Here are some comments from Relay users.

While Relay is an excellent option for business owners, it has some drawbacks that might make it challenging to use. Here are two alternatives to Relay that offer similar features along with additional benefits like access to credit and interest-earning accounts.

Yes, Relay is legitimate. They serve over 36,000 small businesses, have numerous positive reviews on Trustpilot, and are FDIC-insured.

Yes, Relay is a safe place to manage your finances. Relay accounts are FDIC-insured for up to $250,000, and its debit cards are protected against fraud by Mastercard’s Zero Liability Protection Policy.

Relay deposits are FDIC-insured up to $3 million through a cash sweep program run by Thread Bank, Relay’s banking partner.

Opening an account with Relay is straightforward. Complete your application online, providing the following information:

You must also specify your entity type, which influences the required documentation and information for your application.

Relay’s integrated bookkeeping and banking solutions make it an excellent choice for businesses wanting to simplify cash management processes. The ability to create multiple subaccounts and debit cards is especially beneficial for small business owners looking to distribute financial responsibilities among team members. However, if you need access to lending products, you may need to consider other options.