Subscribe

"Unlock exclusive insights and elevate your financial wisdom with NetWorth.com — subscribe now to stay ahead in the wealth game!"

Navigating the complexities of online payments is crucial for any business, and a PayPal Business Account offers a robust solution to streamline this process. This review delves into the features, benefits, and potential drawbacks of using a PayPal Business Account.

From seamless transactions and enhanced security measures to diverse payment options and comprehensive customer support, we provide an in-depth analysis to help businesses determine if PayPal is the right fit for their financial operations.

Whether you’re a small startup or an established enterprise, understanding the capabilities of a PayPal Business Account can be a game-changer in managing your financial transactions efficiently.

>> Streamline Your Payments With Bluevine! >>

A PayPal Business account is a type of PayPal account designed for businesses of all sizes to facilitate online payments. It allows businesses to accept various payment methods, including credit and debit cards, PayPal payments, and other local payment options, from customers worldwide.

This account type offers features such as invoicing, recurring billing, and integration with e-commerce platforms, making it easier for businesses to manage their transactions.

It provides access to business tools and analytics, helping businesses track their performance and streamline their financial operations. With enhanced security measures, PayPal Business accounts protect businesses and their customers during online transactions.

>> Sign Up for a Bluevine Business Account >>

Pros:

Cons:

>> Make Transactions Easy With Bluevine >>

A PayPal Business Account is best for:

>> Start Growing With Bluevine >>

PayPal empowers small businesses to accept and process payments online and in person. The service allows merchants to handle all major payment forms with affordable fees and without a monthly subscription.

Wide Range of Payment Options and Currencies

PayPal business account holders can receive payments from customers who do not have PayPal accounts and manage transactions in 25 different currencies. Online merchants can implement a payment gateway to streamline checkouts on major e-commerce platforms.

Extensive Integration Capabilities

PayPal Business is compatible with many shopping carts, POS systems, accounting software, and e-commerce platforms. The service includes PayPal Payouts for bulk payments and PayPal Zettle (formerly PayPal Here), enabling in-store payment processing.

Seller Protection Measures

PayPal offers around-the-clock monitoring for sellers through its Seller Protection program, addressing two main types of buyer complaints: unauthorized transactions and items not received. Sellers meeting certain criteria are protected under this program.

Subscription Services and Invoicing Tools

PayPal Business users can establish customized subscription payments, offering flexible incentives such as free or discounted trial periods. The platform also provides a free invoicing application featuring customizable templates and straightforward link sharing for easy invoice distribution.

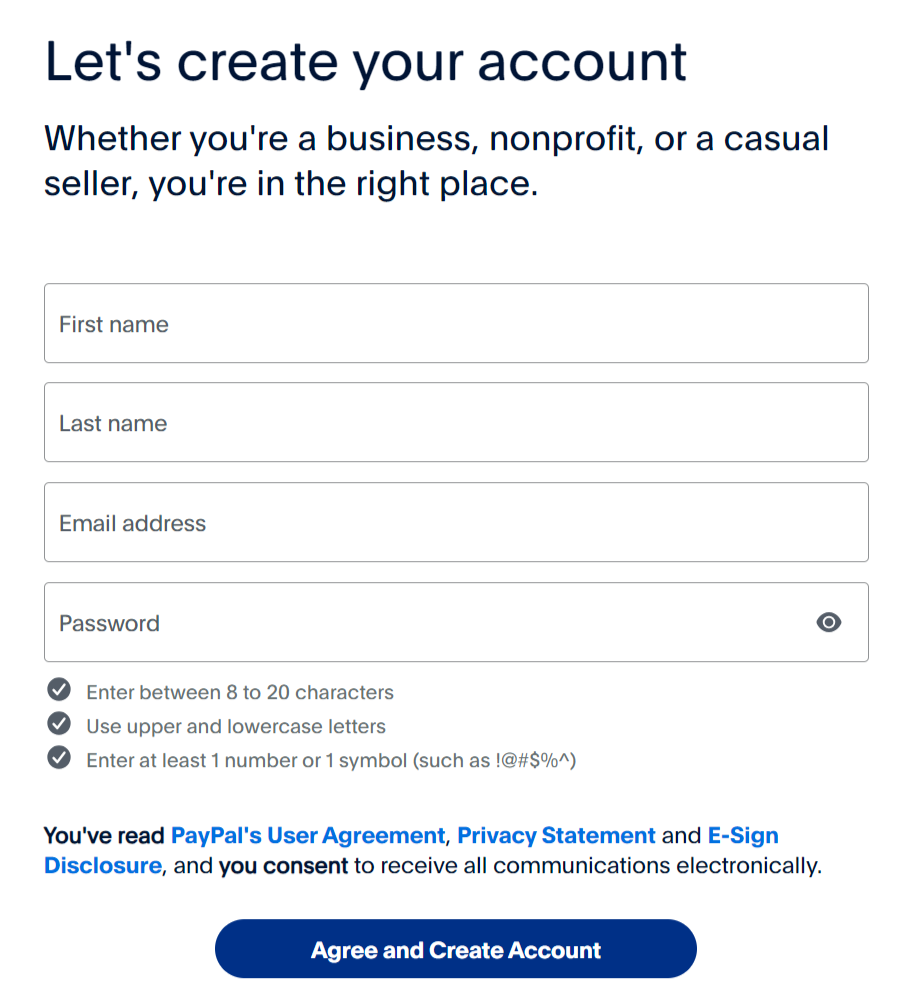

To set up a PayPal business account, follow these steps:

| Service | Fee Structure | Features |

| Per-Transaction Fees | ||

| In-person payments | 2.29% + $0.09 | – |

| Online payments | 2.89% + $0.49 | – |

| PayPal Payments transactions | 3.49% + $0.49 | Includes PayPal, Pay Later, Pay with Rewards, Venmo |

| Recurring Billing | $10 monthly | Add-on service for recurring payments |

| Withdrawal Options | ||

| Standard transfer | Free (3-5 business days) | No currency conversion is involved |

| Instant transfer | 1.5% of amount (min $0.50) | – |

| Chargeback and Fraud Protection | ||

| Chargeback fee | $20 per transaction | For credit and debit card chargebacks |

| Fraud Protection Services | $10 monthly + $0.05 per transaction | Advanced security features |

| Payment Gateways | ||

| Payments Standard | Free | Integrates with shopping carts, redirects to PayPal |

| Payments Advanced | $5 monthly | Lower transaction rates, hosted checkout page, customizable buttons |

| Payments Pro | $30 monthly | Features of Advanced, plus virtual terminal, phone payments |

PayPal offers a comprehensive suite of tools tailored for small businesses, covering various aspects of payment processing, invoicing, and point of sale (POS) solutions:

These tools integrate seamlessly, offering small businesses flexibility and robust functionality.

Accessing funds from PayPal transactions is nearly immediate, with the money swiftly becoming available in your PayPal account. From there, you can use this balance for online purchases wherever PayPal is accepted or transfer it to your bank account. Standard transfers usually take one to two business days and incur no fees.

For those needing instant access to funds, PayPal offers an instant transfer option for a fee of 1.5% of the transfer amount.

Whether opting for a standard or instant transfer, debit transfer limits apply:

There is a $25,000 per transaction withdrawal limit when transferring funds to your bank account.

To contact PayPal customer service, You can call 1-888-221-1161 (inside the U.S.) from 6:00 AM PT to 6:00 PM PT, Monday through Sunday. For international calls, dial 1-402-935-2050. Spanish speakers can call 1-888-914-8072. If you are hearing or speech impaired, use an IP relay service. Alternatively, use the PayPal Assistant chat or leave a message for an agent.

For more help, visit the Help Center or Resolution Center on their website.

To save time, we examined many reviews of PayPal Business Accounts to understand real users’ experiences with the service. This research helps answer whether PayPal is legitimate and effective.

PayPal receives mixed reviews across various platforms, reflecting its dual role as a consumer and merchant service. A significant challenge in assessing negative feedback about PayPal is distinguishing between consumer complaints and merchants’ complaints, as most grievances originate from consumer experiences.

On the Better Business Bureau website, PayPal has accumulated numerous complaints and one-star reviews.

Similarly, its average rating on Trustpilot is a low 1.3 out of 5, predominantly from dissatisfied users, both consumers and businesses.

However, the outlook improves significantly on user review sites like G2 and Capterra, where PayPal boasts excellent average ratings of 4.4 and 4.7 out of 5, respectively, showing a more favorable reception in these forums.

PayPal is highly secure, employing extensive protective policies for buyers and sellers. Each transaction undergoes surveillance for any unusual activity. Additional security measures include top-tier encryption and multifactor authentication.

No, there isn’t. Creating a PayPal business account is free of charge, and you only incur fees once you receive payments. However, a monthly fee will apply if you require advanced checkout features or a virtual terminal.

PayPal offers several advantages for small businesses, including easy setup, a user-friendly interface, many business features, and integrations. It also provides a POS app and affordable POS equipment for in-person sales, making it versatile for online and offline transactions.

However, the platform has high processing fees, particularly impacting online sellers with small average transaction sizes. There is a risk of funds being withheld or accounts being terminated, which can be a significant drawback for small businesses.

PayPal provides multiple support options, including phone assistance, live chat, and a comprehensive knowledge base. However, access to these support services requires logging into a PayPal account.

A PayPal Business Account offers a robust solution for businesses of all sizes seeking a reliable and secure platform for online transactions. Its wide range of features, including invoicing, payment processing, and integration with various e-commerce platforms, provides convenience and flexibility. The account’s global reach and multiple currency support make it ideal for businesses aiming to expand their international presence.

However, potential users should be mindful of transaction fees and consider how these might impact their overall costs. The PayPal Business Account is a valuable tool for businesses to streamline their financial operations and enhance customer payment experiences.