Subscribe

"Unlock exclusive insights and elevate your financial wisdom with NetWorth.com — subscribe now to stay ahead in the wealth game!"

Oxygen’s business bank account helps small business owners and freelancers grow their financial assets. This review of Oxygen highlights its cost-effectiveness, with a free tier, cashback incentives, and interest on savings. We’ll explore Oxygen’s pricing, features, advantages, drawbacks, and alternatives.

>> Experience Better Banking With Oxygen >>

Oxygen stands out as a top business bank account for startup entrepreneurs and independent contractors looking to increase their income. Despite its playful and vibrant website design, Oxygen is serious about helping you boost your earnings through banking.

A key benefit is the basic tier, which has no annual fees or minimum deposits. You also get cashback on purchases from selected merchants and can earn interest annually, regardless of your chosen tier.

However, Oxygen has its downsides. For example, the initial deposit and spending requirements for the paid tiers might be daunting if you’re on a tight budget. There’s also a limit on in-app ACH transfers from external accounts and a high fee for depositing cash to your Oxygen account via Green Dot.

Here’s a summary of the strengths and weaknesses we’ll discuss in this Oxygen business account review:

Pros

Cons

>> Get an Oxygen Bank Credit Card & Enjoy Exclusive Benefits >>

Oxygen is a FinTech company providing banking services through Bancorp Bank. It offers business and personal accounts to separate your professional and personal assets. Founded by Hussein Ahmed in 2017, the company is based in San Francisco, California.

Oxygen excels because it offers multiple earning opportunities. In this review, we’ll explore features like APY, cashback, ATM services, physical and virtual debit cards, deposit options, ACH transfers, savings goals, mobile banking, extra services, security certification, and customer support.

Pricing starts at $0 annual fee.

Who Oxygen Is Best For: Oxygen is ideal for freelancers and small business owners who want to enhance their professional funds through banking transactions. You’ll receive cashback when purchasing from certain sellers with your debit card, and look forward to annual interest, whether you choose the free or paid tiers.

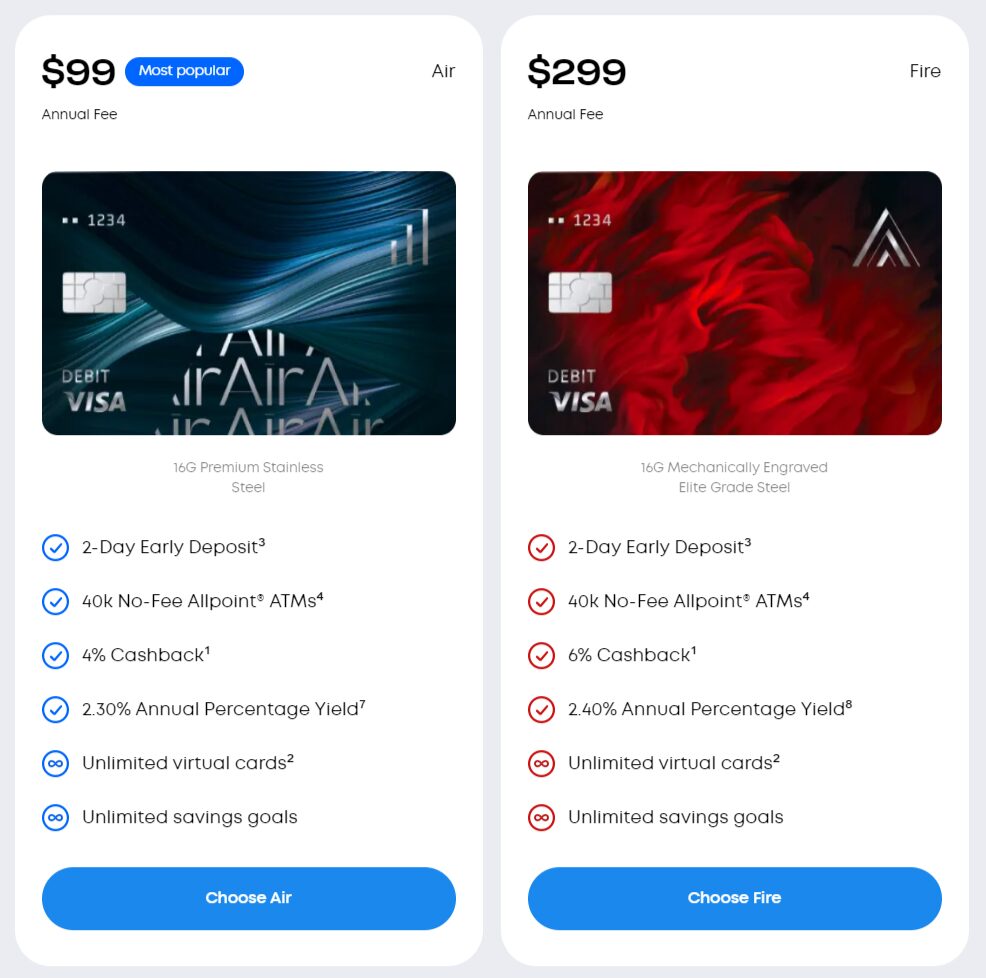

Pricing: Oxygen offers four tiers of business bank accounts:

There’s a 12x cumulative qualifying deposit and spending requirement per year for the Water, Air, and Fire tiers, but Earth account users are exempt.

>> Check Out the Best Pricing for Oxygen >>

Let’s look at the main features of Oxygen’s business account:

Savings APY

Oxygen allows you to earn interest on all business account types. The free Earth tier starts at 0.5% APY, while the paid Water, Air, and Fire tiers progressively increase from 1%, 2%, to 3%, respectively, for balances up to $20,000.

Cashback

Oxygen encourages spending with attractive cashback rewards. Depending on your account tier, you can claim up to 2%, 4%, 5%, or 6% cashback on purchases from approved merchants, plus $1 cashback on food or coffee from selected sellers.

Thanks to a partnership with Allpoint Network, you can withdraw money from over 40,000 ATMs across the U.S. without fees.

All tiers come with an Oxygen Visa Debit Card, varying from a basic PVC foiled card for Earth accounts to an engraved all-metal card for the Fire tier.

For added security, Oxygen allows you to create single-use cards for online purchases, with a cap on the number you can generate based on your account tier.

Oxygen offers early direct deposit, posting transactions on the same day, allowing you to receive funds up to two days earlier. Cash deposits can be made via Green Dot at an additional cost.

ACH Transactions

Set savings goals with challenges like “Round Up Spare Change” and “Save When You Get Money,” with the number of goals you can set depending on your account tier.

Manage your banking on the go with the Oxygen mobile app, available for Android and iOS. It features a sleek UI and easy navigation.

Oxygen offers Bill Pay, money transfers, and various insurance coverages, including mobile phone, luggage, auto rental collision, and hotel theft.

Oxygen, in partnership with FDIC-member Bancorp Bank, ensures the safety of your funds with PCI DSS certification and two-factor authentication.

Oxygen provides daily phone and email support to all business account users, except holidays, from 10 a.m. to 6 p.m. EST.

>> Open a Bank Account With Oxygen >>

Oxygen stands out in this review for its impressive cashback potential. However, before you open a business bank account with them, consider other options that might excel in different business banking areas.

Oxygen is a provider of business banking accounts for entrepreneurs and professionals. It offers four tiers of business savings accounts: Earth, Water, Air, and Fire. The Earth tier is free, requiring no annual fees, deposits, or minimum balance maintenance.

No, Oxygen is not a traditional bank but a FinTech company. However, it provides banking services via its partner, Bancorp Bank. While it lacks physical branches, you can conduct banking transactions through its mobile app and third-party affiliates like Allpoint Network and Green Dot. Its banking services are often more cost-effective than those of many traditional banks.

A business bank account holds your professional assets. It’s a platform for conducting business transactions, like paying suppliers and receiving customer payments. It helps you grow your business funds over time through monetary and non-monetary incentives.

Yes, opening a business bank account is crucial for starting a small business. It’s one of the essential responsibilities of an entrepreneur, alongside other state and federal registration requirements. Separating your business assets from personal savings is vital for proper financial management.

Oxygen enables you to maximize the earning potential of your business savings, making it the cost-effective champion of business bank accounts.

In summary, Oxygen is a financially rewarding choice for small business owners and freelancers due to its free account, APY, and cashback offers. We hope this review has helped you determine if Oxygen is the right fit for you.

>> Open a Bank Account With Oxygen >>