Subscribe

"Unlock exclusive insights and elevate your financial wisdom with NetWorth.com — subscribe now to stay ahead in the wealth game!"

Navigating the complexities of business banking can be a challenge for many entrepreneurs and small business owners. North One, a digital banking platform, aims to simplify this process by offering a range of features tailored to the needs of modern businesses.

In this review, we’ll delve into what makes North One a standout choice in the crowded fintech landscape. We’ll explore its key features, benefits, pricing, and user experiences to help you determine if North One is the right fit for your business banking needs.

>> Open Your North One Account Today! >>

Established in 2017, North One was created to enhance banking solutions for small business owners across various industries. During its inaugural year, the North One team conducted extensive interviews with thousands of small business owners to identify their needs precisely.

With this valuable insight, North One developed a digital banking experience tailored to assist small business owners, freelancers, and startups manage their banking needs effectively. The founders’ commitment is evident in the bank’s comprehensive suite of features that truly cater to the needs of small business owners everywhere.

>> Sign Up for a North One Business Bank Account >>

Pros:

Cons:

North One business checking is particularly suited for small business owners who:

If you require regular cash deposits or international wire transfers, consider Relay Business Checking. It offers these services, ease of integration, and subaccount features similar to North One’s. With Relay, you can deposit cash at AllPoint ATMs without additional fees.

Relay also allows free incoming international wire transfers, and outgoing international wires cost $10 each, or they can be free with an upgrade to Relay Plus at $30 per month.

>> Make Transactions Easy With North One >>

| Feature | North One Standard | North One Plus |

| Monthly Fee | $0 | $20 |

| Same-Day ACH Payments | 1.5% | $0 |

| Physical Checks | $1 per check | $0 |

| Domestic Wire Send | $20 per wire | $15 per wire |

| Domestic Wire Receive | $20 per wire | $20 per wire |

| Bill Pay Access | Free | Free |

| Priority Chat & Email Support | Not included | Included |

| Dedicated Customer Success Manager | Not included | Included |

| Implementation and Onboarding Assistant | Not included | Included |

| Business Banking Essentials | Included | Included |

| Banking for Teams | Included | Included |

| Real-time Sync with QuickBooks | Included | Included |

| Envelopes Budgeting System | Included | Included |

| Profit-first Banking | Included | Included |

| Access to Perks Program | Included | Included |

Here are the key features of North One Business Banking:

>> Start Growing With North One Business >>

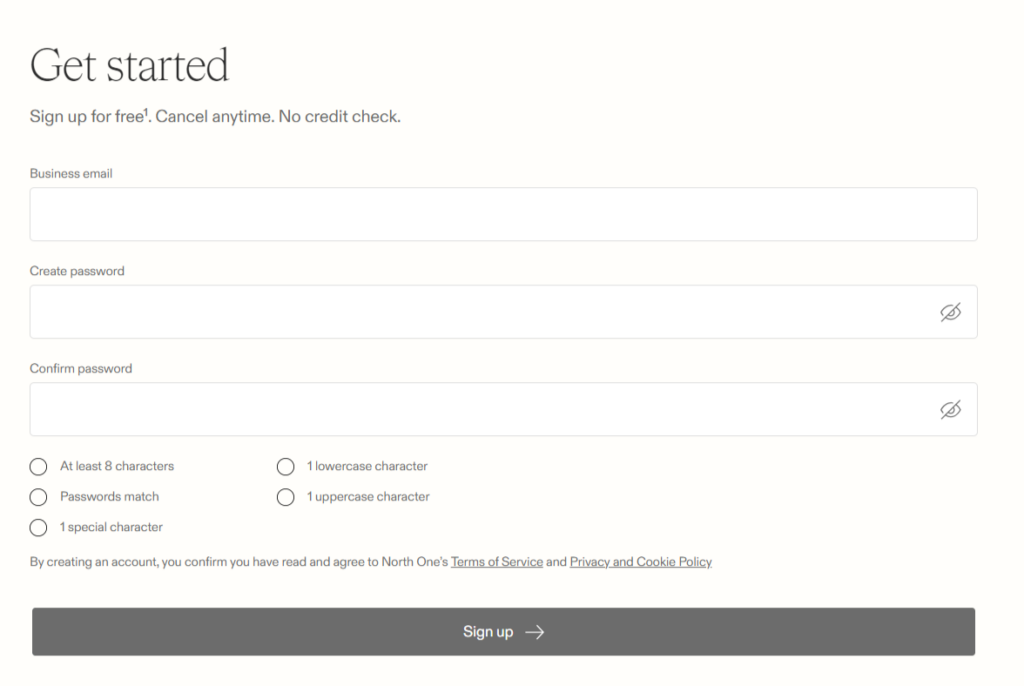

You can open a North One business checking account either online or through the North One app, which is available on iOS and Android platforms.

Eligibility Requirements:

Applications are typically approved within 48 hours. After opening your account, a North One business debit card will be mailed to you and should arrive within 10 business days. Business debit cards can be sent directly to any authorized user, either included at the time of account setup or added later, with a limit of four authorized users per account.

>> Sign Up for a North One Business Account >>

North One’s application for a business account requires specific personal and business information and certain business documentation.

>> Create a North One Business Account >>

>> Make Transactions Easy With North One Business >>

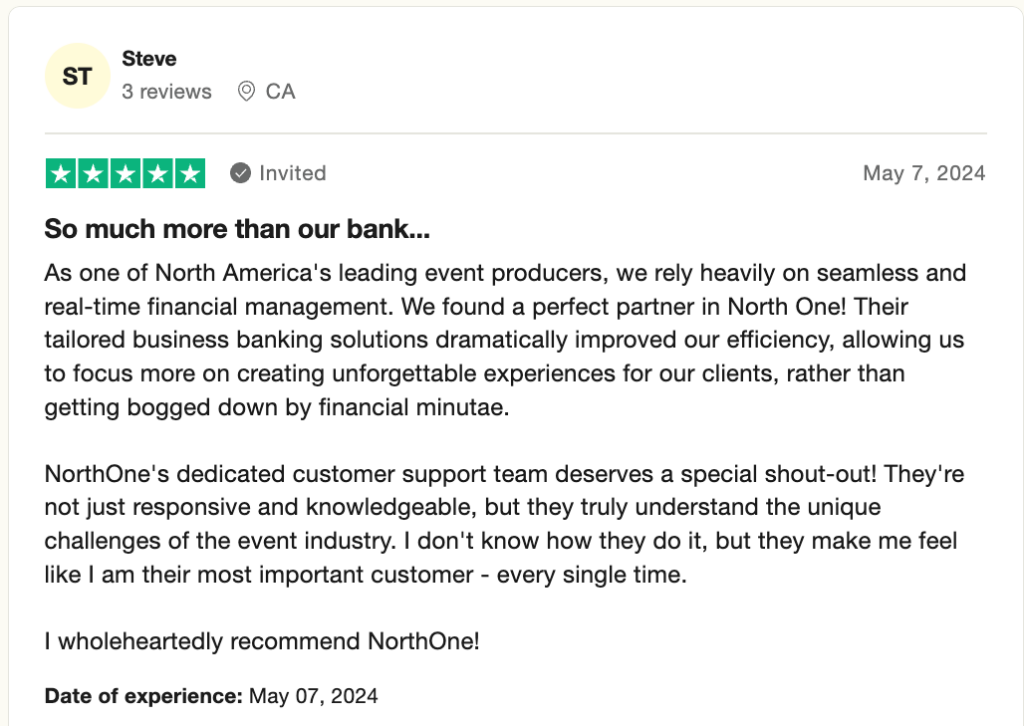

To streamline our process, we analyzed multiple reviews of North One Business Banking to gauge the experiences of actual users. This research aids in determining North One’s legitimacy and efficacy.

User feedback on North One Business Banking from Trustpilot reveals a range of customer experiences, shedding light on the bank’s dependability and quality of service.

User reviews of North One from Trustpilot:

North One is rated 5 out of 4.3 stars on Trustpilot. Customer reviews for North One Bank are predominantly positive, with many users highlighting the bank’s excellent customer service and diverse lending options.

However, a few customers have reported negative experiences, particularly regarding difficulties with account freezing and challenges faced during account upgrades.

Overall, while most feedback is favorable, there are some concerns about customer support in specific scenarios.

Customer support for North One business accounts is available through scheduled calls and a live chat feature within the North One app. The support team operates from Monday to Friday, 9 a.m. to 6 p.m. EST, assisting during these hours for any account-related issues or inquiries. For businesses that require support outside these hours, it’s recommended to consider banking options that offer 24/7 customer service.

>> Streamline Your Payments With North One! >>

North One ensures the safety of deposit accounts with FDIC insurance up to $250,000. For added security, the platform supports biometric verification methods such as TouchID and Face ID.

North One partners with The Bancorp Bank for its banking services.

ACH transfers from North One Bank are usually completed within one to three business days.

Yes, North One provides a mobile check deposit service.

To reach North One, you can call their support number at 332-205-9253, email [email protected], or utilize the chatbox on their website. Although North One maintains four office locations, it does not offer physical bank branches for in-person service.

North One Business Banking offers a streamlined, user-friendly solution for small businesses and freelancers seeking efficient financial management. With its intuitive mobile app, straightforward fee structure, and seamless integrations with popular accounting software, North One is a convenient option for modern business owners.

While it may lack some of the more extensive services offered by traditional banks, its focus on simplicity and accessibility makes it a valuable tool for managing day-to-day finances and providing essential banking services without unnecessary complexity.

>> Register for a North One Business Account >>