Subscribe

"Unlock exclusive insights and elevate your financial wisdom with NetWorth.com — subscribe now to stay ahead in the wealth game!"

As a small business owner, you probably don’t want to spend too much time thinking about your banking and accounting. Most of us have gotten used to juggling two separate services: reconciling transactions in one place while handling bill payments and money transfers in another.

That’s where Found’s Small Business Checking aims to shake things up. Found combines banking and accounting into one platform, offering a comprehensive suite of tools for banking, accounting, invoicing, and tax management. It’s designed specifically for freelancers, 1099 contractors, gig workers, and anyone else running a business solo.

Curious about what Found has to offer? Keep reading this review to learn about its features, benefits, and downsides.

>> Use Found’s Business Checking Account Now! >>

Found isn’t actually a bank; it’s a financial app. It partners with Piermont Bank, a member of the FDIC, to provide banking services. Besides offering a business checking account, Found includes tools for tax tracking, expense management, invoicing, and more.

While Found provides customer service, it’s not available 24/7. You can call or chat with support from Monday to Friday, 8 a.m. to 5 p.m. PT. You can also send a message through the app, and they’ll respond between 7 a.m. and 5 p.m. PT on weekdays and from 7 a.m. to 3 p.m. PT on weekends.

Found’s mobile banking app has high ratings, scoring 4.5 on Google Play and 4.8 on the App Store.

>> Use Found’s Mobile Banking App Now! >>

Found’s standout feature is its suite of tools tailored for small businesses and self-employed individuals. If you’re looking for more perks, many top banks offer competitive benefits as well.

However, there are some drawbacks. Found is a financial app, not a traditional bank, so you won’t find physical branches for in-person banking. Found doesn’t have a free ATM network. The app won’t charge ATM fees, but the ATMs themselves might, meaning you could incur extra charges with each use. There are also fees for depositing cash into your account.

Most of Found’s business checking perks come with the free plan, but earning interest on checking accounts is only available through Found Plus. This premium service costs nearly $20 a month or about $150 annually, which is quite high for an online business checking account.

>> Try Found’s Business Checking Account Today! >>

Pros

Cons

The Found Free Business Checking Account provides a streamlined digital banking solution for entrepreneurs. Everything you need is in one app, eliminating the need for separate banking, tax, and budgeting apps. Plus, if you use QuickBooks for your business finances, you can easily connect it to your Found account.

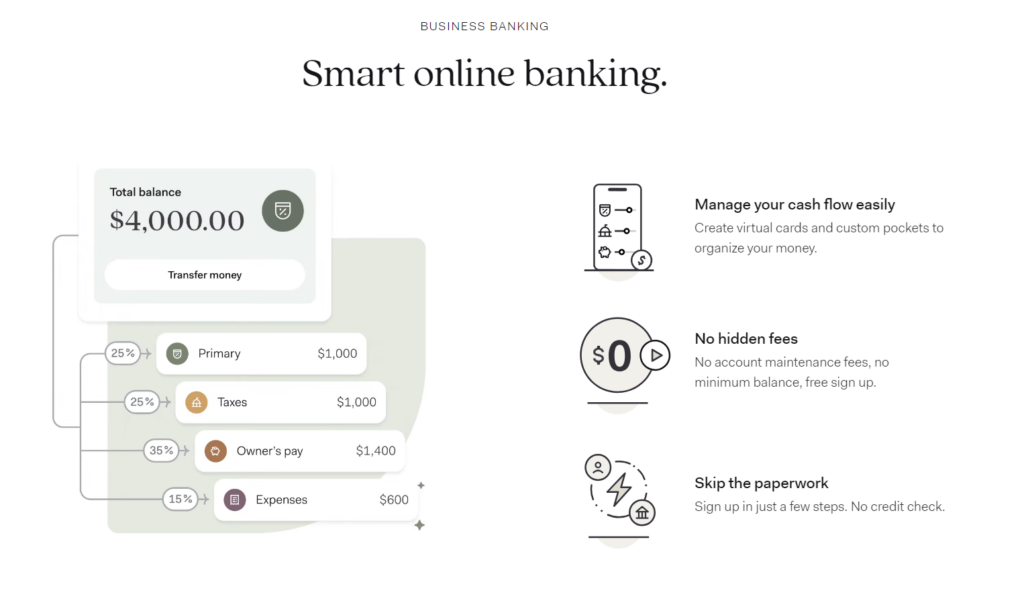

The account comes with several valuable perks. You can organize your money into different “pockets” with specific names and purposes. By default, you get two pockets: “Primary” and “Taxes.” Found’s “smart percentage” feature automatically allocates a portion of your direct deposits into the Taxes pocket, ensuring you always have funds for quarterly taxes. You can also create and name additional pockets to plan for savings goals.

Other notable features include early direct deposit and flexible spending. With early direct deposit, you can receive payments up to two days ahead of time. Flexible spending allows you to overdraw your primary pocket for debit card purchases as long as your other pockets have sufficient funds to cover the transaction.

Found operates exclusively online, offering the convenience of accessing your account from anywhere. This online presence means you can manage your finances whether you’re at home or on the go. However, depositing cash can be more challenging, and getting personalized assistance isn’t as straightforward as with traditional banks.

Found Banking includes innovative financial tools tailored for small business owners. Its tax assistance is particularly beneficial. The pockets system helps you automatically set aside funds for quarterly taxes, alleviating one of the most stressful aspects of self-employment. You can also file your taxes through the app for free if you’re a Found Plus annual member**.

Found offers secure online banking services in partnership with Piermont Bank, which is FDIC-insured up to $250,000 per depositor per account category. Your money is protected, and your financial data is encrypted to ensure safety.

Found also provides 24/7 fraud monitoring, works only with PCI-DSS certified payment partners, and adheres to the SOC 2 Framework, with annual third-party assessments of their security program.

>> Use Found’s Mobile Banking App >>

If you own a single-owner business, you can open a Found business checking account either on the Found website or through its app. These accounts are opened using your personal name and Social Security number, making them ideal for freelancers, gig workers, and sole proprietors. If you have an EIN, you can add it after opening the account.

This process is simpler than what most banks require, which typically includes formation documents like a business license or registration, and the account is opened in your business’s name.

To apply for a Found Business checking account, you’ll need:

You can apply in minutes, though it may take up to seven business days for your Found debit card to arrive. While you wait, you can use a virtual card through the app.

Cash deposits are available via a third-party service at over 79,000 retail locations. Use the Found app to find a nearby location, request a barcode in the app, and scan it at the store to make your deposit. There’s a $2 fee per deposit, which is less than the $4.95 charge from Green Dot, a service used by several online business checking accounts.

>> Try Found’s Business Checking Account Today! >>

Found is perfect for freelancers, entrepreneurs, and sole proprietors who value flexibility, efficiency, and innovation in banking services. It’s tailored for those operating in the digital realm, needing banking solutions that keep pace with their financial needs.

Found addresses challenges like fluctuating income, simplified tax preparation, and efficient expense management.

This platform is especially beneficial for those who prefer the convenience of digital banking combined with powerful tools that automate and simplify financial tasks. Whether you’re dealing with self-employment taxes or looking for streamlined invoicing and expense tracking, Found supports your financial journey.

The mobile-first approach ensures constant access to financial data, enabling real-time decision-making and oversight.

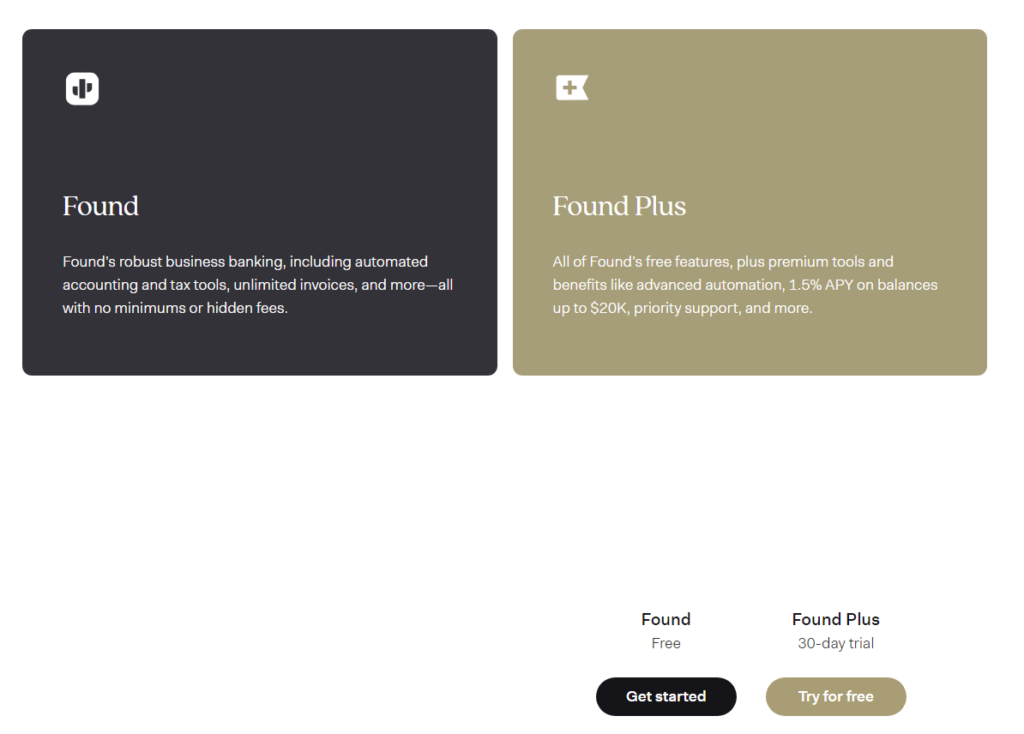

Found Bank offers services catering to different banking needs. The Basic Banking Account is free and includes features like instant deposits, expense management, tax savings, and invoicing. For advanced features, Found Plus is available at $19.99 per month or $149.99 per year, offering unlimited categories and custom rules, photo receipt capture, an APY bonus on balances, and priority customer support.

Invoicing services come with fees based on payment method: 2.9% plus $0.30 per transaction for debit or credit cards, 1% for direct debit, and 3.1% plus $0.30 for Cash App Pay.

>> Get the Best Pricing for Found Here >>

Found offers live customer support via phone and chat during business hours, Monday through Friday, from 8 a.m. to 5 p.m. PT. Weekend support is available via email from 7 a.m. to 3 p.m. PT on Saturdays and Sundays, with no after-hours support. This might be a drawback for side hustlers and gig workers who don’t keep traditional hours and need assistance outside the support window.

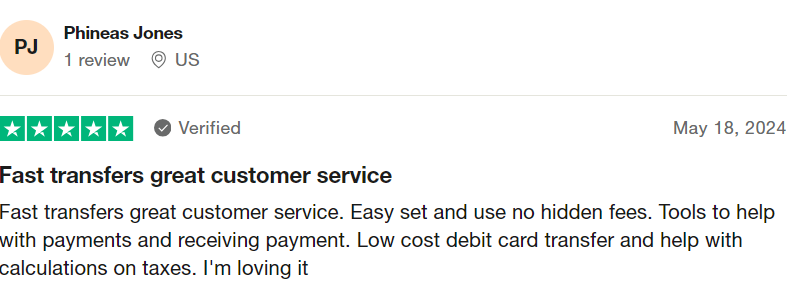

Wondering if Found Bank is legit? Check out these reviews from Found users to help you decide.

Yes, Found Banking is legitimate. It partners with Piermont Bank, which provides FDIC insurance up to $250,000 per depositor for each account ownership category.

Found Banking offers a free version, but its paid version, Found Plus, includes extra perks such as up to 1.50% APY on balances up to $20,000. Found Plus costs nearly $20 per month or approximately $150 per year.

Found Banking is highly recommended for freelancers due to its tailored tools for financial management. It includes features like expense tracking and invoicing, which are specifically designed for freelance work.

Found provides an excellent free business checking account with numerous tools to support self-employed individuals and small business owners. If you’re looking for an app that handles banking, budgeting, invoicing, and tax payments, Found is a solid choice.