Subscribe

"Unlock exclusive insights and elevate your financial wisdom with NetWorth.com — subscribe now to stay ahead in the wealth game!"

In the digital age, with the rise of online payments and banks, the relevance of traditional brick-and-mortar banks is diminishing. However, they still hold a crucial role, offering advantages that mobile banks lack. In this review, we explore Chase Bank, one of the largest full-service banks in America.

>> Open an Account With Chase Bank >>

Chase Bank provides banking solutions tailored for businesses under the banner of Chase for Business. By blending traditional brick-and-mortar operations with online banking, Chase offers a vast branch network and user-friendly online tools. This combination is ideal for small businesses needing the best of both worlds.

As a traditional bank, Chase aims to stay competitive with digital banks by enticing new customers with a $300 bonus for opening a Chase Business Checking account. It ranks fourth among the best business checking accounts.

Pros

Cons

>> Get a Chase Bank Credit Card & Enjoy Exclusive Benefits >>

The Chase Business Complete Banking account is among the top business bank accounts for LLCs. This account offers the best of both offline and online banking, with access to 16,000 Chase ATMs and 4,700 branches across the U.S. and user-friendly online banking tools.

This account provides several benefits for business owners, starting with the sign-up bonus. By opening a Chase Business Complete Banking account and depositing $2,000, maintaining it for 60 days, and completing one of the required activities within 90 days, you’ll earn a $300 bonus.

If maintaining the minimum deposit for the bonus is challenging, you can still open an account with Chase, as no minimum deposit is required. The rewards continue with a $750 bonus cash back for new business credit card members and unlimited 1.5% cash back on all purchases after spending $7,500 in the first three months.

However, the Chase Business Complete Banking account may not suit those seeking interest earnings, as most Chase accounts do not offer interest. If you prefer to avoid visiting a branch in person, this may not be your account, as opening a Chase Business Complete Banking account requires an in-person visit.

This account is ideal for business owners needing in-person support and access to many ATMs nationwide while using mobile and online banking tools.

Consider the Chase Business Complete Banking account if your business handles many transactions without incurring per-transaction fees, online transactions are unlimited.

If you’re interested in a fee-free business account, check out our detailed reviews of Oxygen, Kabbage, and SoFi, which provide information on the pros, cons, and alternatives to these FinTech companies.

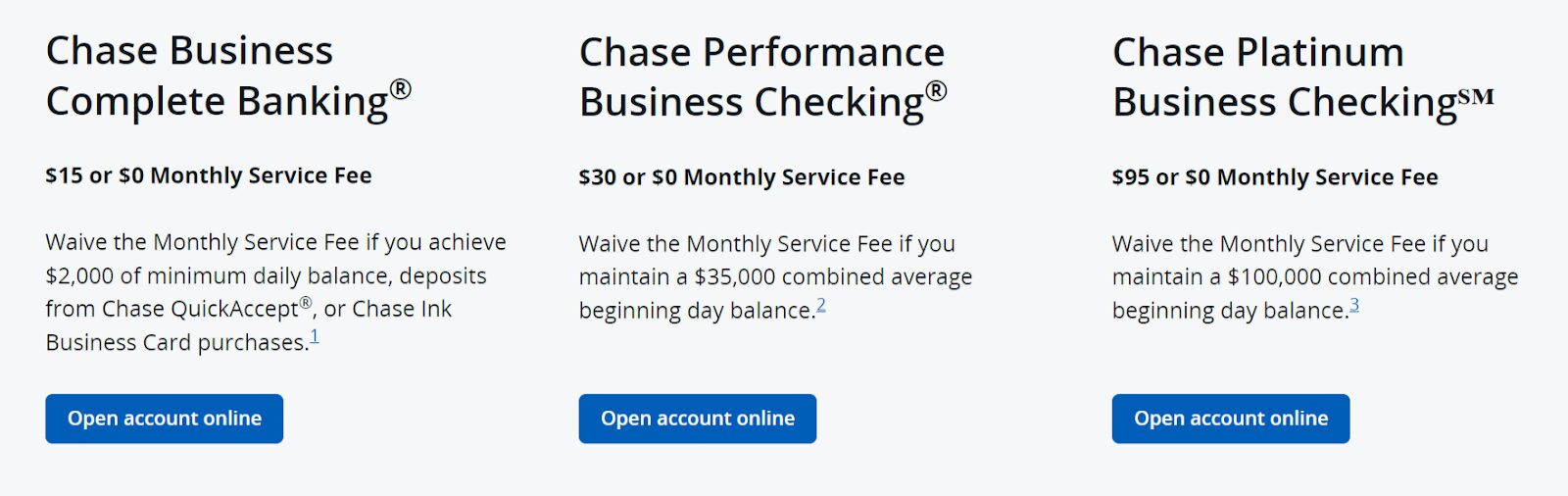

This review mainly covers Chase Business Complete Banking, which is best suited for small-business owners. Chase offers three business checking accounts: Chase Business Complete Banking, Chase Performance Business Checking, and Chase Platinum Business Checking.

To help you understand the different price tiers in the business checking accounts, we’ve compared the main features of these three accounts.

>> Apply for Chase Bank Student Loan Refinancing! >>

As a traditional brick-and-mortar bank with digital banking tools, Chase Bank Business accounts provide many benefits, including in the entry-level options. Here are the main features:

The Chase Mobile® Banking app is user-friendly, secure with encryption technology, and offers several useful features for business owners. These include online bill pay and payment schedule, fraud protection, sending and receiving payments, account alerts, and setting up multiple account users directly from the app.

Chase Bank offers a great opportunity to earn extra cash if you’re seeking a business checking account with a sign-up bonus. Newcomers who open a Chase Business Complete Checking account, deposit $2,000, maintain it for 60 days, and complete five qualifying activities, such as debit card purchases and Chase QuickAccept deposits, receive $300.

Earn a $750 bonus cash back when you spend $7,500 on purchases within the first three months after opening your account. Enjoy 5% cash back on the first $25,000 spent in combined purchases at office supply stores and on internet, cable, and phone services each account anniversary year.

You’ll also get 2% cash back on the first $25,000 spent in combined purchases at gas stations and restaurants each account anniversary year with the Ink Business Cash® credit card.

Your business can accept credit and debit card payments with Chase QuickAccept via the Chase Bank app. This service works with a mobile card reader to process tap, swipe, or dip transactions, allowing you to receive funds in your account the same day.

While most brick-and-mortar business checking accounts require a minimum opening deposit, the Chase Business Complete Banking℠ account is an exception. You can open this account even with no initial funds.

If you need clarification on whether the Chase Bank Business account is the right fit for your business, several alternative options are worth considering. Here are some of the best:

According to our analysis, opening a business account at Chase Bank has pros and cons. The disadvantages include the requirement to waive monthly service fees, low to zero interest-earning potential, and the need for in-person visits to open an account.

Yes, most Chase Bank accounts, including business accounts, charge monthly fees. However, there are ways to waive them, such as maintaining a certain balance or setting up direct deposit.

Chase Bank offers many benefits for small business owners seeking in-person help and a robust online banking service. You can make cash deposits, access many fee-free ATMs nationwide, visit a branch if needed, or manage your account from your mobile phone.

Overall, Chase Bank offers many advantages for small business owners, especially those who need to make cash deposits, require in-person assistance, want access to fee-free ATMs, and appreciate the convenience of online business banking on the go.