Subscribe

"Unlock exclusive insights and elevate your financial wisdom with NetWorth.com — subscribe now to stay ahead in the wealth game!"

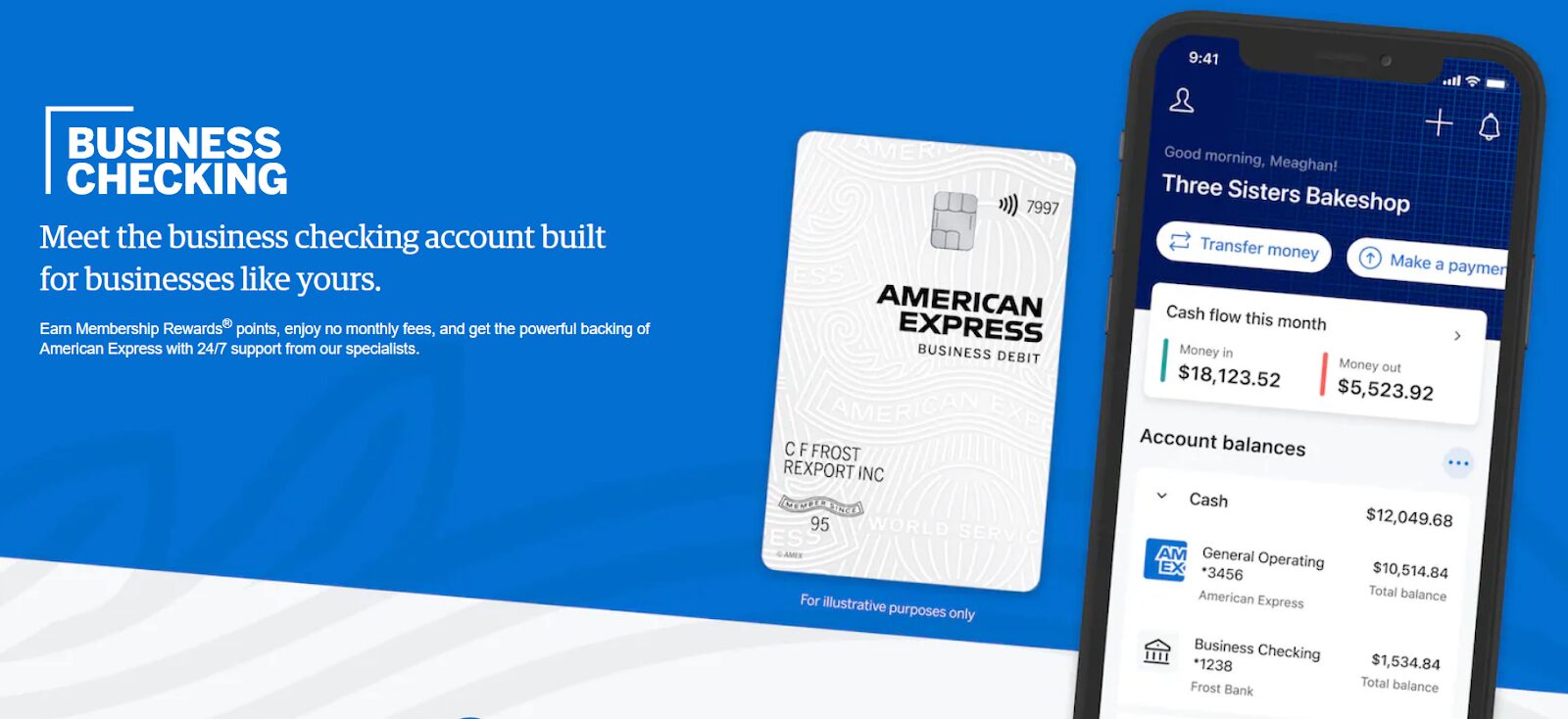

American Express National Bank (Member FDIC) is renowned for its credit cards, but its American Express Business Checking (Member FDIC) is also impressive.

This account has minimal fees, earns interest, and benefits from Amex’s highly regarded customer service. Discover if this account is the right fit for your small business in this American Express Business Checking review.

>> Explore Bluevine Business Checking Now! >>

American Express launched its fully digital Business Checking account in October 2021, introducing a household name to a market dominated by lesser-known banks and fintech companies.

This free business checking account competes well with other online options, offering no monthly fees or charges for services like stop-payment requests and incoming wire transfers. What sets American Express Business Checking apart is its 24/7 live customer service, competitive interest rate, and generous welcome bonus.

Account holders can deposit funds via mobile check deposit, ACH, and wire transfers. Withdrawals can be made free of charge from more than 70,000 MoneyPass and Allpoint ATMs in the U.S. However, cash deposits are not accepted, and fees may apply when using out-of-network ATMs.

>> Discover Bluevine Business Checking Benefits! >>

The American Express Business Checking account is the sole business bank account offered by American Express. However, the bank also provides a range of other services, including credit cards, merchant services, and lending solutions.

>> Open Bluevine Business Checking Today! >>

The American Express Business Checking account is free, with no monthly maintenance fees and minimum balance requirements. It offers a generous 1.30% Annual Percentage Yield (APY) on balances up to $500,000, though no interest is earned on amounts exceeding this limit.

In addition to interest, you can earn 1 Membership Rewards® point for every $2 spent on eligible Business Debit Card purchases, which is rare for business checking accounts.

This account also comes with a competitive welcome bonus. You can earn 30,000 American Express Membership Rewards® points by opening an account and meeting the following criteria:

Qualifying transactions include mobile deposits, check deposits by mail, and electronic/online transactions such as ACH, wire, and bill payments.

The account provides access to over 70,000 surcharge-free Allpoint and MoneyPass ATMs and supports mobile check deposits. While you can order checks through a third-party service, e-check services are included. However, cash deposits are not available.

American Express operates without physical branches, so customer service is available online or by phone. Currently, the bank does not support Zelle, so payment services are limited to ACH and wire transfers.

In addition to the business checking account, American Express National Bank provides several other financial products:

American Express also offers a variety of business and personal credit cards, merchant services, and a business line of credit, as described below.

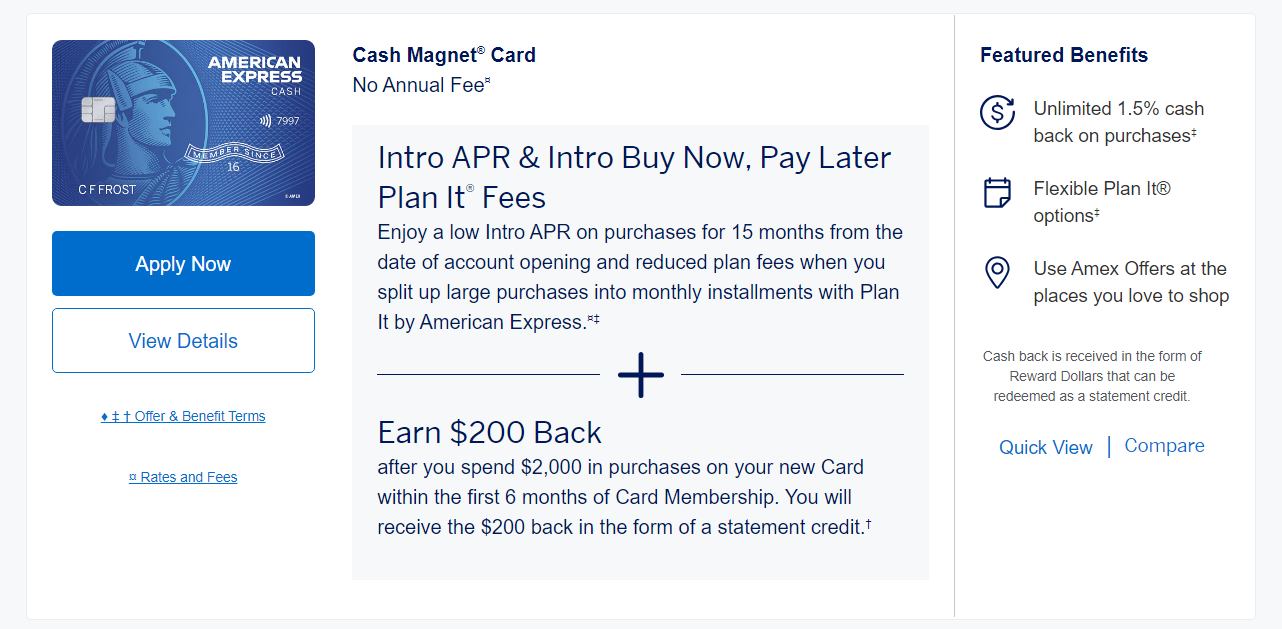

American Express credit cards are highly popular among both consumers and business owners. They offer a range of options, including cash-back cards, travel rewards cards, and premium personal and business credit cards.

Additionally, there are several co-branded travel cards with partner hotels and airlines like Hilton and Delta and rewards cards that earn Membership Rewards points.

Here are a few popular American Express business cards (terms apply):

Business owners with a physical location or those who want to accept payments through their American Express Business Checking account should consider American Express Payment Accept. This service allows you to send custom URL payment links and create professional invoices.

Payment Accept charges 2.25% per transaction, which is lower than many other payment processors. However, please note that this service is not currently accepting new customers, but you can join the waitlist if interested.

The American Express® Business Line of Credit is available to businesses operating for at least one year with a minimum average monthly revenue of $3,000. Eligible businesses can borrow amounts ranging from $2,000 to $250,000.

Existing American Express customers can log into their accounts and complete a pre-filled application, while non-customers can apply. Each application undergoes an approval and review process.

This line of credit allows approved businesses to borrow funds for business needs, with each draw treated as a new installment loan. The interest rates vary based on your credit profile and loan term. The total monthly fees over the loan term range as follows:

Fees are variable and are charged per draw on the line of credit.

Amex doesn’t have physical branches, but there are still numerous ways to manage your money.

The main drawback is the inability to make cash deposits at a branch. However, you can fund your account through several alternative methods:

The last option, accepting credit card payments, is a separate service called American Express Payment Accept. It allows you to accept credit card payments from clients and customers, and there are specific terms and fees associated with the service.

While you can’t visit a branch to withdraw money from a teller, there are plenty of ways to access your funds, including the option to pull out cash:

ATM withdrawals are free at thousands of in-network MoneyPass® ATMs. Withdrawals from non-network ATMs may incur fees, and foreign transactions will include a fee for withdrawing money in a foreign currency or from a foreign ATM.

American Express is an excellent choice for many businesses, from startups to larger companies, looking for comprehensive financial services in one place. It could be a good fit for your business if you want to:

One major benefit of American Express business checking is the availability of 24/7 customer service. You can also use the company’s website’s FAQs section or chat feature. You can call 24/7 at (855) 497-1040 for phone support.

No, American Express Business Checking isn’t compatible with Zelle, which is common for business bank accounts.

Yes, you can integrate your American Express Business Checking account with QuickBooks accounting software. Additionally, you can connect your Amex business credit cards for seamless financial management.

No minimum income or revenue requirement exists to open an American Express Business Checking account. Additionally, no minimum deposit is needed to open the account, though a deposit may be required to qualify for a welcome bonus.

Yes, American Express’s Business Checking account is FDIC insured for up to $250,000 per depositor for each account ownership category. Businesses with deposits exceeding $250,000 should be aware that amounts over this limit may not be protected.

American Express is renowned for issuing both personal and business credit cards, offering some of the best business cards on the market. It recently ranked top in the industry in a J.D. Power study.

Their business checking account also boasts unique features, such as a 1.3% APY and the ability to earn Membership Rewards points, similar to a credit card. This makes it an ideal choice for small businesses that travel frequently and already take advantage of the travel perks offered by American Express business credit cards.