Subscribe

"Unlock exclusive insights and elevate your financial wisdom with NetWorth.com — subscribe now to stay ahead in the wealth game!"

Navy Federal is a credit union based in Virginia. Membership is open to active and retired service personnel, certain civilian contractors, and their family members. It serves over eight million members through a network of more than 330 branches, including locations overseas and on military bases.

Navy Federal provides various business services, including checking and savings accounts, loans, and credit cards. Additionally, they offer specialized services such as payroll management and products to assist with automation.

In this article, we’ll explore the business accounts offered by Navy Federal, explain how to apply for one, and provide details on the features and fees that may apply.

>> Explore Bluevine Business Checking Now! >>

Navy Federal offers three business checking accounts tailored to assist new, growing, and mature companies: Business Checking, Business Plus Checking, and Business Premium Checking.

All three accounts feature no or low monthly service fees and unlimited free electronic transactions, making them an excellent choice for growing businesses. However, these accounts are not available to everyone.

You must be a Navy Federal Credit Union member limited to military service members, retirees, veterans, Department of Defense employees, and their families.

>> Discover Bluevine Business Checking Benefits! >>

Navy Federal Credit Union Business Checking is a straightforward account designed to meet the needs of small business owners. It features no monthly service fees and offers unlimited free electronic transactions.

The first 30 non-electronic monthly transactions, which include processed checks and in-branch transfers, deposits, and withdrawals, are also free. After that, there’s a fee of $0.25 per transaction.

The account offers a minimal 0.01% APY. To open a business checking account, you must be a Navy Federal Credit Union member and make a minimum deposit of $250 for sole proprietorships or $255 for other business entities like LLCs, partnerships, and corporations. You can also add up to two signers to your account.

>> Open Bluevine Business Checking Today! >>

The Navy Federal Credit Union Business Plus Checking account is excellent for growing businesses with moderate transaction volumes. It offers free and unlimited electronic transactions. The first 50 non-electronic transactions each month are also free, with a fee of $0.25 per transaction thereafter.

The Business Plus account has an $8 monthly service fee and offers a 0.01% APY. You can add unlimited additional signers to share account access. Funds can be moved into your account via ACH transfer, mobile check deposit, or by visiting a Navy Federal branch or ATM.

Additionally, you can transfer funds using a Visa or Mastercard from an external financial institution.

Mature businesses with a high volume of transactions may find the Navy Federal Credit Union Business Premium Checking account an ideal option.

This account offers unlimited free electronic transactions and 100 free non-electronic transactions per month, with additional non-electronic transactions costing $0.25 each. Like the Business Plus Checking account, you can add unlimited signers.

This account comes with a $20 monthly service fee, which can be waived if you maintain an average daily balance of $5,000 or more. The Business Premium Checking account offers three different APYs based on your account balance:

Alternative Option:

If you seek a higher interest rate without sacrificing 24/7 customer support, consider American Express Business Checking. Like Navy Federal’s, this account is free and offers unlimited transactions and round-the-clock phone support.

Additionally, you can earn 1.30% APY on balances up to $500,000. However, AmEx doesn’t have physical branches and cannot accept cash deposits.

Navy Federal Credit Union offers two types of memberships: regular membership and business membership.

To qualify for regular membership, you must be one of the following:

To meet the requirements for Navy Federal Credit Union business checking, you must already be a Navy FCU member with personal accounts in good standing. You must also submit the necessary business documentation when applying for business membership.

Navy Federal provides money market accounts and business certificates.

The Navy Federal Credit Union business credit card, known as the GO BIZ Rewards Credit Card, enhances purchasing power with no annual fee. Its APRs range from 14.40% to 18%.

Like the GO BIZ Debit Card, it features a zero-liability policy to protect account holders from fraud and is available as a Visa and Mastercard.

Its rewards program distinguishes the GO BIZ Credit Card from the debit card. For every $1 spent, cardholders earn 1 reward point, which can be redeemed for rewards such as gift cards, cash back, and airline tickets.

Navy Federal Credit Union offers a variety of lending products:

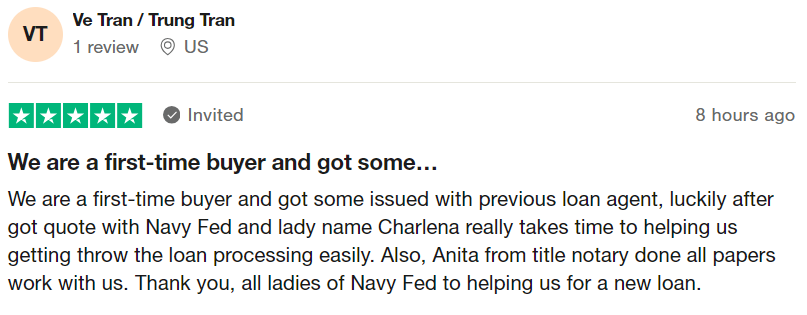

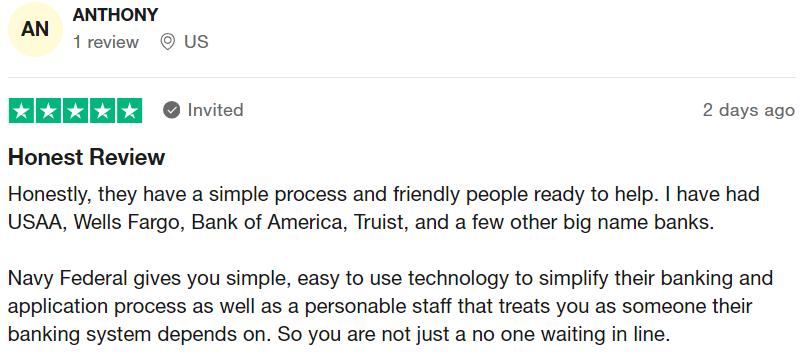

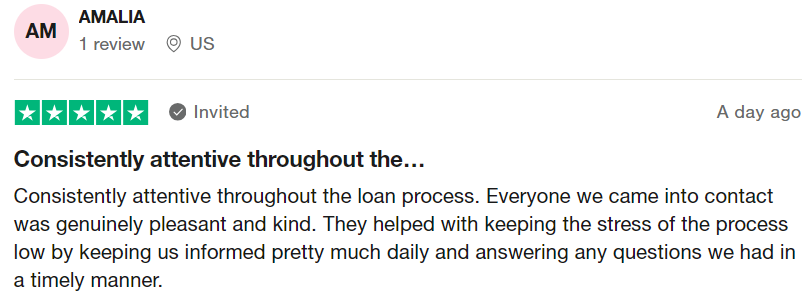

Navy Federal Credit Union has received positive feedback from satisfied customers on several review platforms. Here are some reviews of Navy Federal Business from Trustpilot.

Navy Federal is an excellent option for business accounts, as its checking account offers unlimited transactions without any fees. This is particularly beneficial for businesses with a high volume of transactions, such as retail stores or restaurants.

Additionally, Navy Federal provides numerous perks tailored to military members, making it an attractive choice for those in the service.

A Navy FCU business checking account allows you to earn an APY, perform unlimited fee-free electronic transactions, and have a business debit card with zero liability protection.

First, you need to be an active member of the U.S. armed forces, a veteran, or a relative or household member of someone in the military. All business owners must join the credit union with personal accounts. After completing an online application, you must submit the required documentation.

If convenience, affordability, and flexibility are your business banking priorities, opening a business account with Navy Federal is worth considering. They offer three affordable business checking accounts and extensive business lending and savings products.

Additionally, with a wide range of physical branch locations, in-person banking is easy and accessible. However, membership is limited to active and retired members of the U.S. Armed Forces, their family members, and DoD civilians.