Subscribe

"Unlock exclusive insights and elevate your financial wisdom with NetWorth.com — subscribe now to stay ahead in the wealth game!"

SoFi is a fintech company that individuals and businesses can use to manage and grow their funds securely. This review of SoFi outlines all the advantages and disadvantages to help you determine if it’s the right choice.

>> Open an Account With SoFi >>

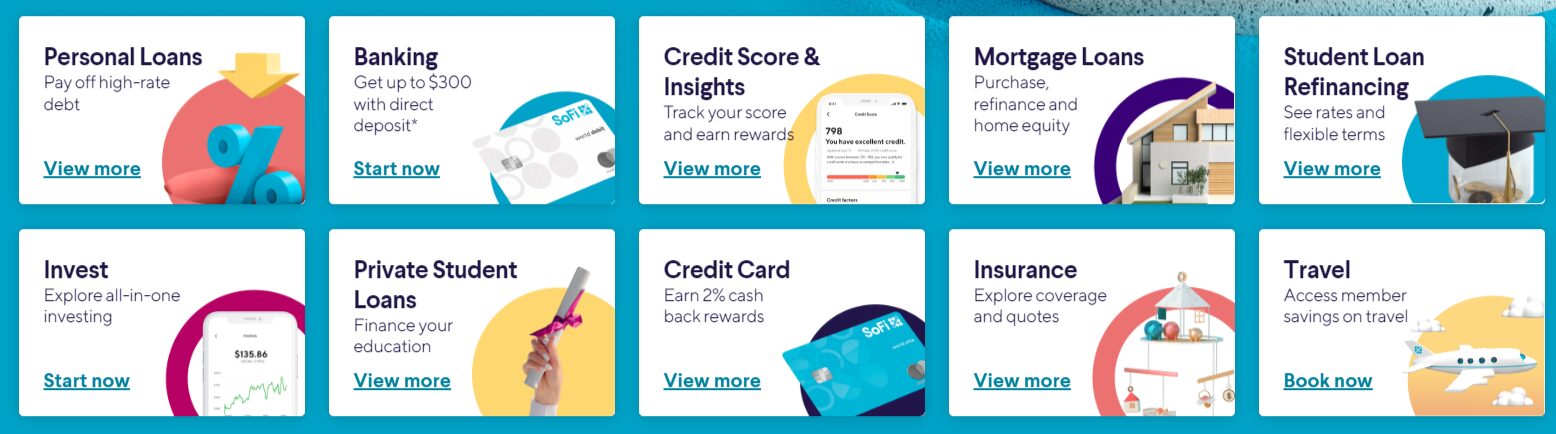

SoFi offers a range of products, from loans to banking and insurance. Sole proprietors, partnerships, and LLCs aiming to differentiate business and personal finances will find appealing options here.

Its bank account minimizes fees while offering high-interest rates and the flexibility to manage funds as needed. For projects requiring significant investment, SoFi provides financing options to ensure you take advantage of opportunities.

Pros

Cons

>> Experience Better Banking With SoFi >>

SoFi is a financial platform providing savings, checking, and lending solutions for small business owners. Setting up an account is free, and except for loans, there are no monthly fees. This extends to cash deposits, transactions, and overdraft fees, which other institutions often charge.

The platform offers a 1.25% APY for checking and savings, requiring a direct deposit to secure this rate. SoFi’s single credit card offers 2-3% cash back, enhancing income.

SoFi is renowned for providing personal loans and introducing business financing through its Lantern Credit service. While SoFi doesn’t directly provide these loans, it connects you to various leading options for business owners.

Small business owners will benefit most from SoFi’s services. Its banking services lean more towards personal use, but individual business owners can fully utilize a bank account. Joint accounts are also available for partnerships sharing business responsibilities. Maximizing the interest rate for checking and savings is possible with direct deposit.

SoFi is committed to minimizing fees wherever possible and offers one of the highest interest rates among online and traditional banks.

SoFi is relatively new to banking. It offers a single savings and checking account. There are no minimum deposits, monthly fees, or balance requirements.

Accessing SoFi’s 1.25% APY is straightforward with a linked direct deposit. Without this, you’ll still earn 0.70% on both accounts, well above the industry norm. The platform dislikes fees, offering free money transfers and point-of-sale transactions both domestically and internationally. A linked direct deposit forgives overdrafts up to $50.

Using any of the 55,000+ ATMs in SoFi’s network incurs no charges. However, when using out-of-network ATMs, expect fees from the ATM itself. SoFi’s wire transfer fees are typically at $25 to $30 for domestic and closer to $50 for international transfers.

>> Check Out the Best Pricing for the SoFi >>

SoFi has several standout features that make it an appealing online bank.

SoFi provides a single credit card for business purchases. MasterCard offers 2% cash back, increasing to 3% with a linked direct deposit. This card has no annual fee but, depending on your credit score, can vary in APR from 13.74% to 25.74%. The option to issue multiple cards to employees needs to be mentioned.

>> Get a SoFi Credit Card & Enjoy Exclusive Benefits >>

Banking with SoFi opens both a checking and savings account simultaneously. Both accounts earn the same interest rate of 0.70% or 1.25% with a direct deposit.

No monthly fees or minimums apply, allowing free movement of cash. Be cautious not to overdraft your checking account by more than $50. Joint accounts are available for multiple business owners.

Small business owners seeking insurance will find options suitable for startups and small enterprises. SoFi currently offers auto, life, renters, and homeowners insurance, but these cannot be extended to employees.

SoFi offers a unique incentive for business owners to assist employees with student loan debt. Contribute up to $5,250 tax-free annually towards employees’ student loans, with employers able to deduct this amount while attracting recent graduates.

>> Apply for SoFi Student Loan Refinancing! >>

SoFi’s app enables real-time fund transfers and receipts. It facilitates online bill payments and sets up recurring payments for vendors or employees. Check deposits are simple, done by photographing the check and specifying the destination.

SoFi is committed to low fees. Account setup is free, monthly fees are non-existent, and there are no charges for overdrafts up to $50, cash transfers, or deposits. Fees apply only for outgoing wire transfers and out-of-network ATM usage.

If you seek a business account with minimal fees, consider detailed reviews of Oxygen, Capital One, and Lili, covering pros, cons, and alternatives.

SoFi’s Lantern Marketplace helps business owners explore and compare leading loan options. While not a direct lender, SoFi facilitates finding the necessary loans by providing pertinent business and location information to Lantern.

If your credit card is compromised, you can freeze it instantly via the SoFi app. SoFi monitors for suspicious activity and alerts you immediately. Two-factor authentication and unique transaction codes for each card purchase bolster account security. All funds are FDIC insured up to $250,000.

While SoFi suits many business owners, it might only meet some needs. Explore these alternatives for a better fit.

SoFi ticks all the boxes as a bank and lender. Its funds are insured by FDIC, and the Better Business Bureau gave it an A+.

It was originally Social Finance, Inc., a name the founders chose in 2011. These days, it’s SoFi Technologies, but the social element in its business is still strong.

Sure thing! Thanks to FDIC insurance, once your cash lands in your account, SoFi covers it up to $250,000.

By the end of 2021, SoFi boasted about 3.5 million members, showing a staggering 90% growth from the previous year.

SoFi is an excellent starting point for small businesses aiming to grow their funds’ interest. To enjoy SoFi’s top rates, you just need a direct deposit, even if it’s your own payment to yourself.

This financial service provider offers loan options from several third-party companies, so you’re not stuck with just one choice. With minimal fees, you can maximize your money without it trickling away.

>> Apply for a SoFi Loan Today! >>