Subscribe

"Unlock exclusive insights and elevate your financial wisdom with NetWorth.com — subscribe now to stay ahead in the wealth game!"

U.S. Bank offers an array of business checking accounts, streamlining payments, purchases, and deposits for business owners. It also offers investment options perfect for those looking to grow their wealth. This in-depth review will explore why the U.S. Bank is ideal for startups and small and medium-sized businesses.

>> Open a U.S. Bank Account Today! >>

U.S. Bank provides various business-friendly products. They have five different checking accounts, savings accounts, money market accounts, CDs, credit cards, loans, and a business line of credit, among other financial options. This wide range of services lets entrepreneurs easily scale their operations, upgrading their banking packages as their businesses expand.

>> Earn Interest With U.S. Bank Account >>

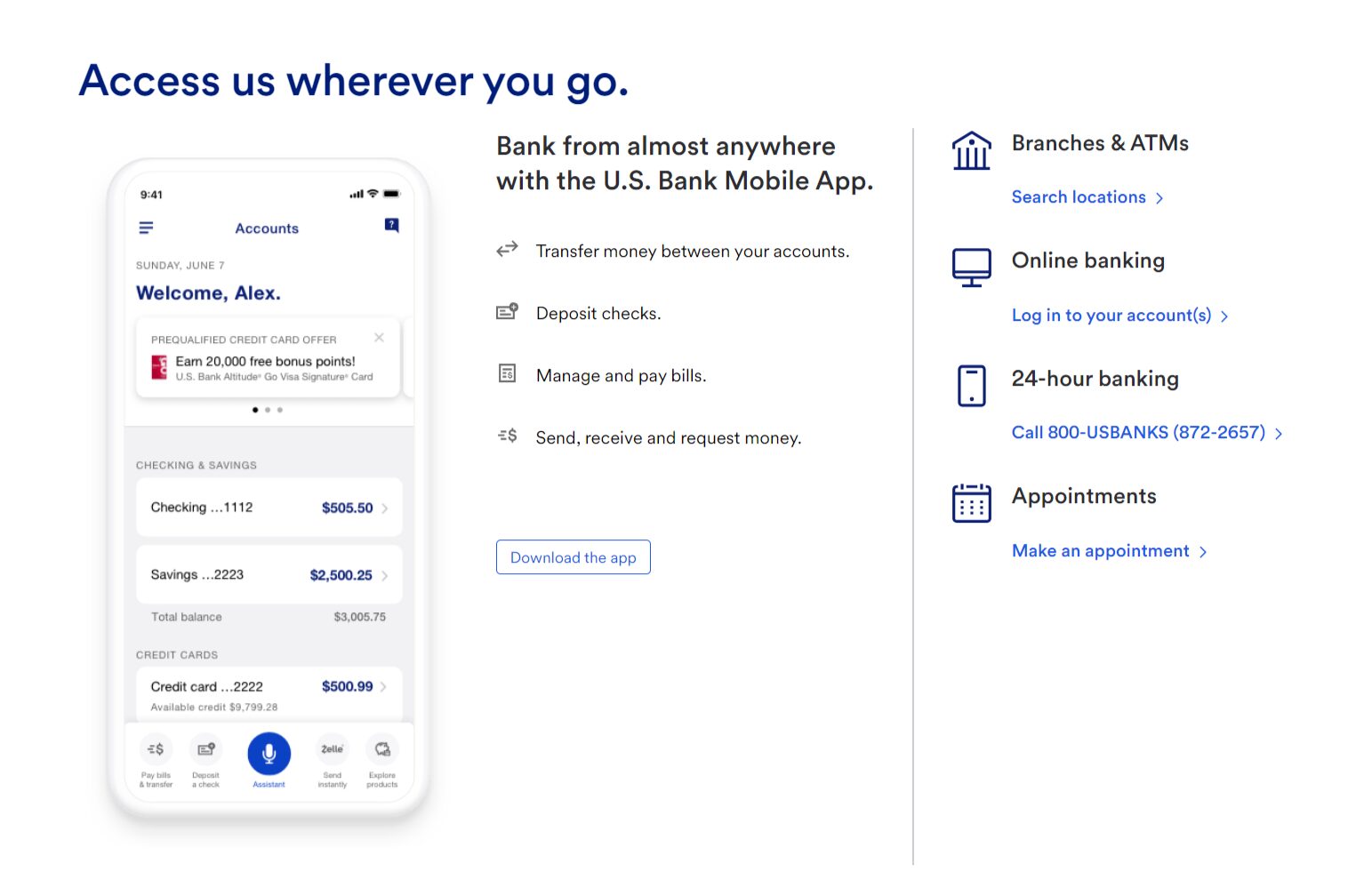

U.S. Bank stands among America’s top five largest banks. It offers a solid selection of business accounts and financial services. U.S. Bank provides extensive access to its services with over 3,200 branches in 26 states, more than 5,000 ATMs, and a user-friendly mobile app.

Customers benefit from comprehensive financial solutions through web support and in-person visits to branches. However, U.S. Bank has notable downsides, such as excluding extra features even for premium accounts.

It offers average interest rates, making it smarter to consider other options for saving your money.

U.S. Bank is an excellent choice for small businesses seeking friendly starter accounts. It offers a variety of products tailored for businesses with low transaction volumes and fluctuating balances. However, more established companies that need advanced banking packages, additional features, and higher APYs on their balances might find better deals with other banks.

>> Experience Modern Banking With U.S. Bank >>

U.S. Bank provides five checking accounts, with the Silver, Gold, and Platinum accounts being the most popular. The Silver package offers enhanced simplicity and convenience for smaller firms, while the Gold package is best for medium-sized businesses seeking flexibility and value.

The Platinum package delivers better rewards and benefits, making it more suited for well-established businesses that maintain higher balances. U.S. Bank offers a Premium business checking account for larger businesses, ideal for companies with complex banking needs wanting to earn credit rates on qualifying balances.

Here’s a simplified comparison chart of the most popular checking accounts to help you pick the best option for your business needs:

| Features | Silver | Gold | Platinum |

| Monthly maintenance fee | $6.95 | $14.95 | 24.95 |

| Number of free monthly transactions | 125 | 300 | 500 |

| Number of free cash deposits monthly | 25 | 100 | 200 |

| Stop payment fee | $35 | $35 | $35 |

| Overdraft fee | $36 | $36 | $36 |

| Overdraft protection transfer fee | $12.50 | $12.50 | $12.50 |

The popular U.S. Bank checking accounts are not interest-bearing products. Even though the Platinum Checking account offers interest rates, they fall well below the national average of 0.05%. For more attractive interest rates on your business balances, consider looking into CDs, savings, or money market accounts instead.

>> Check Out the Best Pricing for the U.S. Bank>>

U.S. Bank might boast only some feature-rich banking solutions. Still, you’ll find all the essential services to keep your business running smoothly. Here’s what you can expect.

U.S. Bank’s mobile app is user-friendly and has secure digital banking tools. It simplifies everyday banking. Pay bills and transfer funds with ease. Check your current balances, deposit checks, access tax documents, and view e-statements from your Android or iOS.

U.S. Bank prioritizes fraud protection. They’ve set up measures to secure credit card check payments and mobile app transactions. The bank encrypts all wireless communications during digital banking to reduce the risk of information money or identity theft.

Another standout feature of U.S. Bank accounts is remote deposit. To avoid the hassle of mailing paper checks, you can snap a photo of your checks with your smartphone and send the images to the bank for deposit.

The EZ switch kit makes changing banks simple. U.S. Bank offers reliable support throughout the process to ensure a smooth, fast, and easy transition. With their five-step process, you can easily open a business account with U.S. Bank and close your old one, all without causing any downtime for your company.

>> Open a U.S. Bank Account Today! >>

U.S. Bank is an excellent choice if you value a bank’s reputation and stability. However, better options are available if you’re seeking more features and higher APYs on your balances. Let’s explore three alternatives.

When you open a business checking account with U.S. Bank for the first time, you’ll receive a bonus of up to $399, which will be deposited into your account within 45 days after deposit verification. Your account must maintain a positive balance to qualify for the bonus. Other perks include 50% off your first check order (up to $50) and a discounted rate of $49 for a mobile card reader.

As of 2021, there were 4,914 FDIC-insured financial institutions in the United States, including U.S. Bank. U.S. Bank’s checking accounts are insured for up to $250,000 per person, protecting against the loss of your insured deposit.

Under the USA Patriot Act Section 326, financial institutions must obtain, verify, and record information identifying individuals who open accounts. Therefore, U.S. Bank will ask for your business’s EIN or tax ID number, documents showing your company’s formation like Articles of Organization, and your SSN if you want to register with your business account.

>> Get Free ATMs Worldwide With U.S. Bank >>

U.S. Bank offers excellent business bank accounts and is a solid option for small business owners who prefer in-person banking and easy access to thousands of fee-free ATMs. Thanks to its technology-forward approach and highly-rated mobile app, it’s also great for entrepreneurs interested in digital banking.

The U.S. Bank provides a reliable range of financial products with enough flexibility to support growing businesses. The main tradeoff is that most accounts have high fees and low interest rates, which might be better for larger companies. We hope this comprehensive U.S. Bank business account review helps you make an informed decision.

>> Open a U.S. Bank Account Today! >>